Need better financial business decisions

Effective decision-making in today’s complex and disrupted business environments must be connected, contextual, and continuous to drive good outcomes.

When you start a business, you’ve suddenly got all kinds of new responsibilities. One of the most important is the decision-making involved in accounting, taxation, and financial management.

Importantly, this isn’t about re-engineering every financial decision; it’s about applying this re-engineered thought process to the most important and impact full decisions — those that can’t be made effectively with traditional approaches.

To curb garbage-can decision making, managers and their teams should think more carefully about the information they need to solve a problem and think more strategically about how to apply it to their decision making and actions. Setting this up will require a good consideration of what kind of data you need, what data you could exploit, what pieces of the decision making are best left to humans and what should be handled by digital technologies. And determine the collaborations that are critical, rather than what you can manage.

To curb garbage-can decision making, managers and their teams should think more carefully about the information they need to solve a problem and think more strategically about how to apply it to their decision making and actions. Setting this up will require a good consideration of what kind of data you need, what data you could exploit, what pieces of the decision making are best left to humans and what should be handled by digital technologies. And determine the collaborations that are critical, rather than what you can manage.

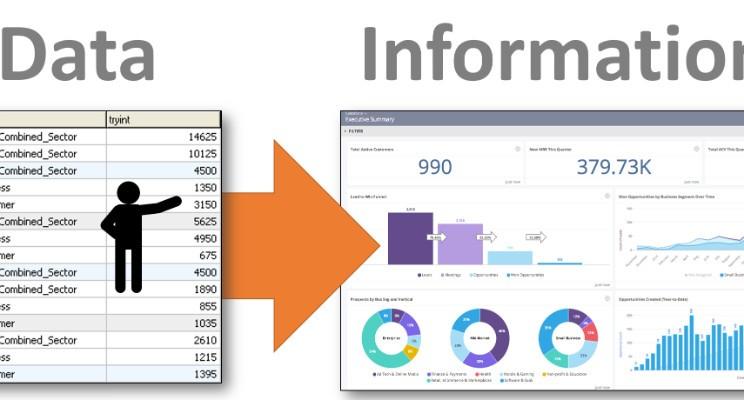

We at DigiAccounto recommend the data GUCM approach, which provides four steps of intentional thought to help convert data into knowledge and wisdom. Most businesses are inundated with oceans of data, yet not much of it helps you make decisions that improve results. This could be because it is either not the right kind of data or it hasn’t been compiled and analyzed properly. In other words, it is not information to make a decision, it is just data. The GUCM approach by DigiAccounto features steps to eliminate clutter and improve decision making. They include:

G - Getting accurate data

Of course, you need good data in the first place. Make sure you have what you need and it is reasonably accurate, but consider how you will use it and how much of a difference accurate data will make in your decision-making. Accuracy of details is also something you need to manage so you don’t end up overwhelmed with details or spend too much effort getting details that simply don’t matter in the end. For instance, if you are tracking costs as part of a process in order to make management decisions, does your tracking method have to tie into the financial system and match to the penny? Does it have to be a live link with your own system, or can you download the needed information from the financial system daily or weekly?

U - Using analytical tools

Use tools that help you analyze the information and data you have. You can use digital tools and enterprise systems that are designed for data analysis as well. Some digital tools and resources allow you to store data as soon as it’s generated, making this a seamless data collection method that can pay off in the form of customer insights.

The key thing is to step beyond lists and printouts and start analyzing the data in a way that’s meaningful to your responsibilities.

The key thing is to step beyond lists and printouts and start analyzing the data in a way that’s meaningful to your responsibilities.

C - Converting data to information

Information is when you take the data you have and analyze it or manipulate it by combining it with other data, trending it over time, assessing or analyzing the outliers that need to be dealt with, and most importantly, applying your own experience and knowledge to transform that data into something you can use to make a decision with. The report, list, or printout usually doesn’t do it. The real value of data is in comparisons and trends. Compare the results from one call center agent to the average or to another call center agent. Look at the trends in sales or expenses over time, or some other factor. Assess your response or delivery times against geography, product, personnel, seasons, or other factors. And, of course, use bench-marking approaches to compare both within and outside your organization.

M - Making decisions with the information

After you’ve gathered and analyzed your data and converted it into information, you should consider what’s important to your decision. If there is any question about the accuracy or completeness of your data, or if you are using historical information to do projections, do a variance analysis—if it was 25% higher, would you make the same decision? What is the likelihood that the result will be in that range? How big of a risk will it be? What parts of the information are important to the decisions you want to make? How will they impact the success or failure of your initiative? How much weight do they have compared to other factors? For instance, when looking at costs and how you may implement processes, approvals, or other methods to reduce them, will you be causing costs to increase elsewhere? What is the real likelihood that you will be able to make the reductions you project?

Any successful entrepreneur will tell you that their prime objective is to maximize profits while minimizing operational costs at all times. And one way to achieve this is by updating the financial data as accurately as possible. But in truth, no one wants to deal with bookkeeping pressure after a long day marked with a beehive of administrative activities. Unfortunately, accounting is an inevitable task and one of the key measures of how your business is doing.

Lest, the big question.

How do I look to get my financial data updated and properly recorded?

The good news is that there’s a way to make the whole process simpler and quicker. The solution is to hire a highly qualified accounting and financial management firm that can bring a wealth of insights to help you assess financial performance, risks, and opportunities, as well as develop the right accounting systems and practices to ensure accuracy, efficiency, and compliance.

Financial planning and budgeting, process optimization, managing cash flow, payroll management, bookkeeping, procurement optimization, and inventory management. These are just a few of the functions that depend upon clear, clean, and complete data—and require the best available financial tools to ensure good data is swiftly and accurately transformed into actionable insights and smart business decisions.

Engaging DigiAccounto is an opportunity to tap into a global talent pool and hire highly qualified experts with extensive industry knowledge and experience in improving the efficiency of accounts receivable and accounts payable processes that are vital to ensuring steady cash flow. With contemporary digital systems, our experts will keep an eye on metrics like expenses, past-due invoices, and operating cash flow. Generating and tracking cash reports daily to help you plan for the future because you’ll see changes or fluctuations you can use to inform other decisions.

Thanks You

Regards

Aditi Garg

Director

Accutech Digi Accounto Private Limited

Regards

Aditi Garg

Director

Accutech Digi Accounto Private Limited

Write a Comment