Friends, As you know India is a country where gifting is an usual activity, there are so many occasions on which one person gives gift to others. By this one express its love, affection and attachment towards others. Sometime its love or sometime it’s become status symbol.

But, have you ever think, persons can use this practice to plan their taxes, even it was a very famous practice to save taxes because after abolishment of Gift Tax Act 1958, in October 1988 all gift was became tax free. But in 2004 gift tax was reintroduced by introducing provisions in Income Tax Act.

Since then, these provisions were changed many times, in this business accounting & taxation mantra (Business ATM), we Digi Accounto will cover, gift tax in India in all aspects, it will enable you to understand that, how to tax gift in India, Gift tax in India, Tax on Gift, Gift under Income Tax and many more, this deep understanding of law will help you to avoid tax evasion, litigation, notices and penalties.

Now, the question arises in every mind, that, how to tax gift in India. In this business mantra we will provide you deep understanding about Gift tax in India and various provisions such as Gift Tax, Gift of Property, Gift of Immovable Property, Gift of Shares, Gift of Movable Property.

For understanding Gift tax in India, we can divide gift into following parts:

1. Any sum of Money received without payment of any consideration ie Money Gift

2. Specified movable properties received without payment of any consideration ie Gift of Movable property without consideration

3. Specified movable properties received by paying some consideration but it is less than its fair market value ie by payment of inadequate consideration ie Gift of Movable property on inadequate consideration

4. Immovable properties acquired without payment of any consideration ie Gift of Immovable property without consideration

5. Immovable properties acquired by paying some consideration but it is less than its fair market value ie Gift of Immovable property on inadequate consideration.

We will take all above mentioned gifts in details but before that we need to understand that, if any gift transaction happens between any of persons, or at any of occasion mentioned below, it will not be taxed…

Any sum of Money, or Specified Movable property, or Immovable property received or acquired…

1. Gift From relatives.

Meaning of relative here is:

A) In case of an Individual

a) Spouse of the Individual

b) Brother or sister of the Individual

c) Brother or sister of the spouse of Individual

d) Brother or sister of the either of the parents of the Individual

e) Any lineal ascendant or descendent of the Individual

f) Any lineal ascendant or descendant of the spouse of the Individual

g) Spouse of the persons referred to in (b) to (f)

B) In case of HUF, any member thereof

2. Gift On the occasion of the marriage of the Individual.

3. Gift Under will or by way of inheritance

4. Gift In Contemplation of death of the donor

5. Gift From a local authority

6. Gift By way of transaction not regarded as transfer under section 47(viiac)/ (viiad)/ (viiae)/ (viiaf)

7. Gift From an individual by a trust created or established solely for the benefit of relative of the Individual.

Now, we will understand parts of gift tax in details one by one…

First – Tax treatment for any sum of Money received without payment of any consideration by an Individual or HUF

Any sum of Money ie money gift received in cash, cheque, draft etc, received by an Individual or HUF will be charged to tax if

The aggregate value of such monetary gift received during the year exceeds Rs 50000.

Here it is important to note that, the aggregate value of gift here is only for the purpose of determination of taxability of gift, once it becomes more than Rs 50000 in a year, in that case full amount received as gift will be charged to tax.

We will take some examples for this

Ex-1: Mr Garg received below mentioned gifts during FY 2022-23

Rs 1, 80,000/- from his friend residing in US

Rs 25,000 from his brother residing in Mumbai

Rs 88,200 from his friend residing in Mumabi on the occasion of birthday

What will be the tax treatment of above items in the hands of Mr. Garg

First aggregate value of total gift received by Mr Garg is in excess of Rs 50000/- in FY 2022-23

Now see, Rs 1, 80,000/- received from his friend is fully taxable in the hands of Mr Garg, as friend is not covered under the definition of relatives

Rs 25,000 from his brother will not be charged to tax, as brother is covered in the definition of relative

And Rs 88,200/- will also be taxable in the hand of Mr Garg as gift received only on the occasion of marriage is not exempt from tax, while received on every other occasion such as birthday, gift will be taxable except it is not under the list of non-taxed gifts.

Second – Specified movable properties received without payment of any consideration ie Gift of movable property without consideration

For taxation of gift of movable property, government has specified specific movable properties. Mean to say, any movable property received as a gift, which is not covered under the list of specified movable properties, will not be charged to tax in the hands of receiver.

Specified Movable Properties – Shares/Securities, Jewellery, Archaeological collections, drawings, paintings, sculptures, any work of art and bullion and virtual digital assets (VDA), in the nature of capital assets of the taxpayer.

Gift of Movable Property| Specified Movable Property| Digi Accounto | Gift Tax in India | Tax on Gift | How to Tax Gift in India | Gift Under Income Tax | Gift Tax | Gift on Property

Taxation

Any specified movable property received as a gift by an Individual or HUF will be charged to tax if –

The aggregate fair market value of such movable properties in a year, exceeds Rs 50,000/-

In that case, fair market value of such properties will be treated as income of the receiver.

Here it is important to note that, the aggregate value of specified movable properties here is only for the purpose of determination of taxability of gift, once it becomes more than Rs 50000 in a year, in that case full fair market value will be charged to tax.

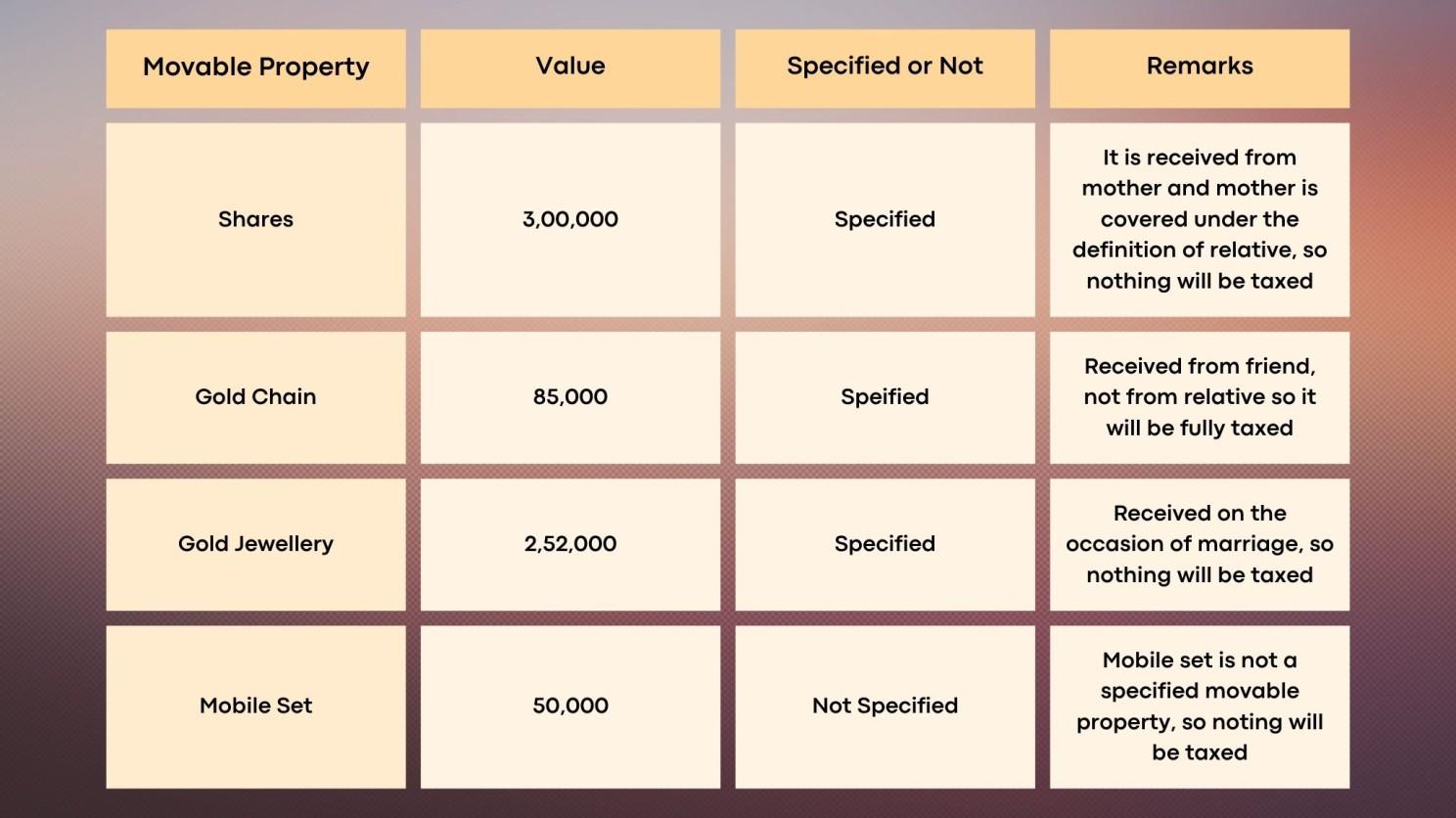

Ex- Mr Kapil received following gifts during FY 2022-23

- Received share, having fair market value of Rs 3, 00,000 from his mother

2. Received a Gold Chain from his friend, valued at Rs 85,000/-

3. Received Gold jewellery from his friend on the occasion of his marriage, valued at Rs 2, 52,000/-

4. Received mobile set from his friend as a gift, valued at Rs 50,000/-

Advice Mr Kapil regarding tax treatment of above gifts

First we need to know aggregate fair market value value of Specified Movable property received during the year

So, as per above table, aggregate value of specified movable property, which is taxable is in excess of Rs 50,000 ie Rs 85,000/- so full fair market value of Rs 85,000/- will be taxable in the hand of Mr Kapil.

If in the above example, gold chain received from friend, would be valued at Rs 45,000/-, in that case aggregate value of specified movable property, which is taxable will not be in excess of Rs 50,000 ie Rs 45,000/- so nothing would be taxable in the hand of Mr Kapil.

Third – Specified movable properties received by paying some consideration but it is less than its fair market value ie by payment of inadequate consideration ie Gift of movable property on inadequate consideration

Taxation

Any specified movable property acquired by an Individual or HUF will be charged to tax if –

The difference between the aggregate fair market value of such movable properties and the consideration paid by person for acquiring the same, in a year, exceeds Rs 50,000/-

In that case, entire difference between fair market value of such properties and the consideration paid, will be treated as income of the receiver.

Here it is important to note that, The difference between the aggregate fair market value of such movable properties and the consideration paid by person for acquiring the same here is only for the purpose of determination of taxability of gift, once it becomes more than Rs 50000 in a year, in that case entire difference will be charged to tax.

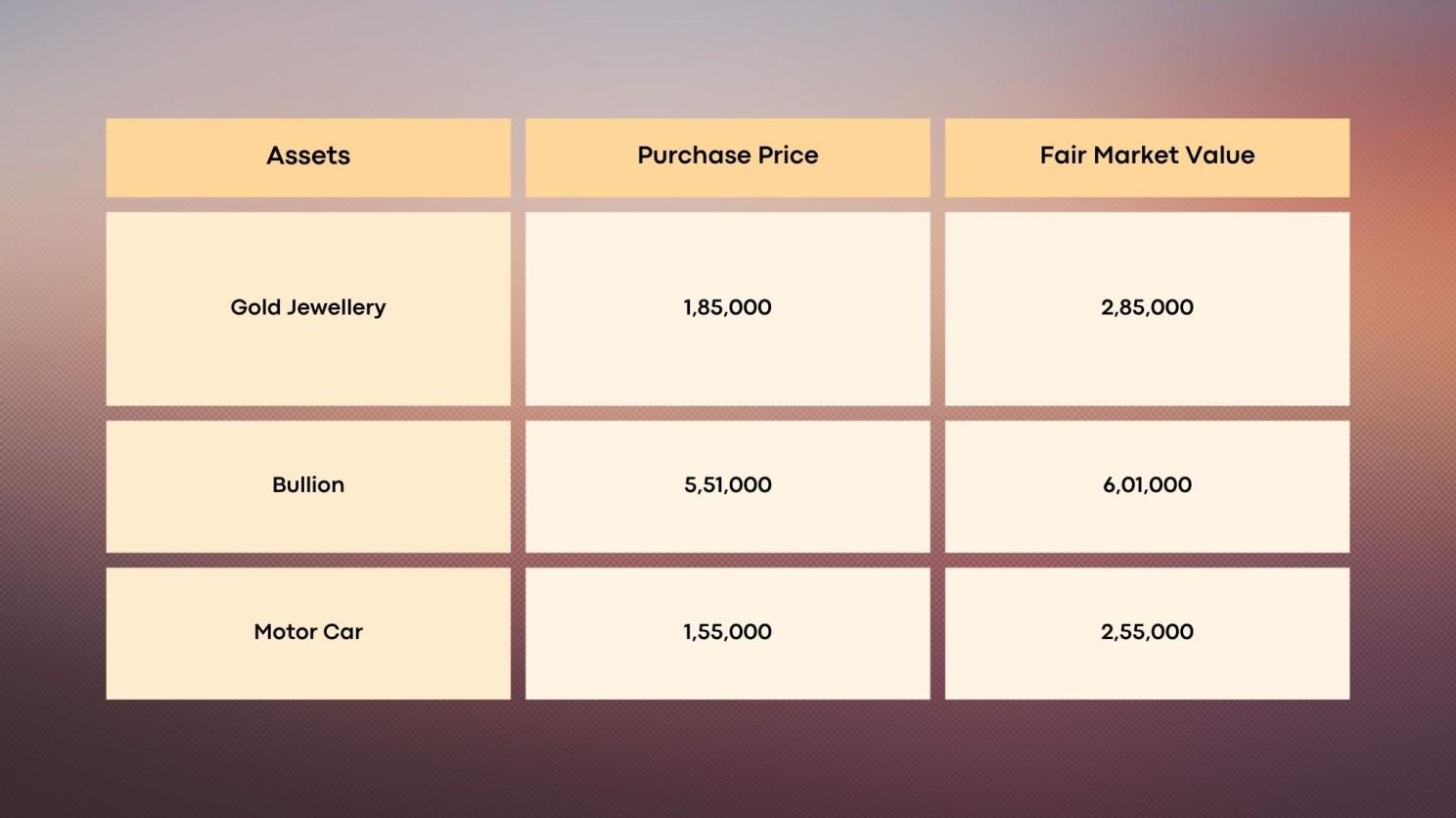

Ex- During the FY 2022-23, Ms Sangeeta purchased following assets:

Gift of Movable Property| Specified Movable Property| Digi Accounto | Gift Tax in India | Tax on Gift | How to Tax Gift in India | Gift Under Income Tax | Gift Tax | Gift on Property

In the above example, we can easily determine that Gold jewellery and Bullion are covered under specified assets definition, while Motor car is not covered under it.

So, Fair Market value of total specified assets is Rs 8,86,000/- against which Purchase price for the same assets is Rs 7,36,000/-. The difference between Fair market value and Purchase price of specified assets comes to Rs 1,50,000/- ie above Rs 50,000/-. In that case complete excess over purchase price ie Rs 1,50,000/- would be taxable in the hands of Ms Sangeeta under the head “Income from other sources”

As Motor car does not covered under specified assets, so noting will be taxable.

Another Example:

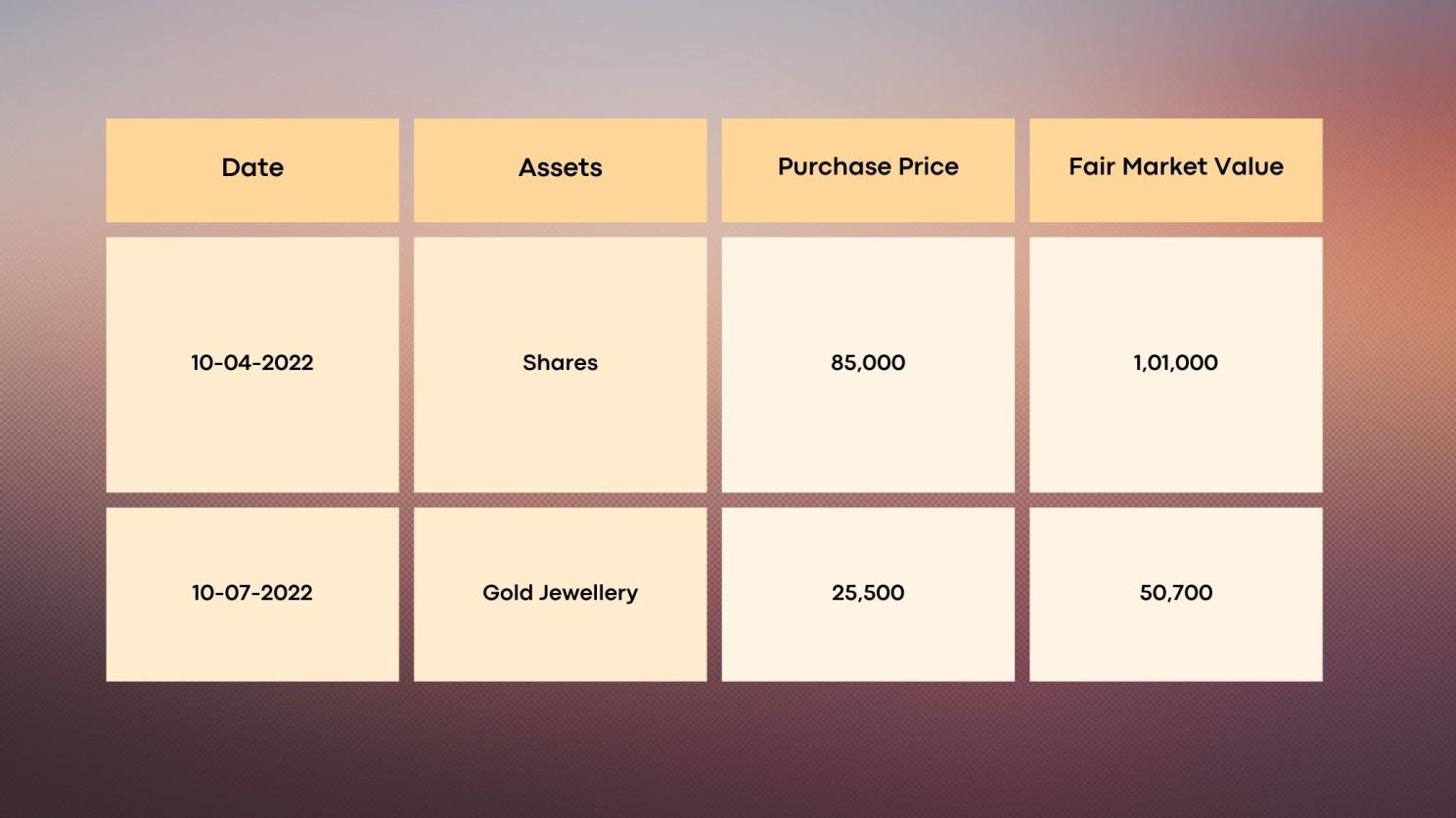

Ms. Rashi purchased following assets

In the above example, we can easily determine that gold jewellery and Shares both are covered under specified assets definition.

So, Fair Market value of total specified assets is Rs 1,51,700/- against which Purchase price for the same assets is Rs 1,10,200/-. The difference between Fair market value and Purchase price of specified assets comes to Rs 41,500/- ie below Rs 50,000/-. In that case nothing would be taxable in the hand of Ms Rashi.

Fourth – Gift of Immovable Property ie without consideration

Taxation

Immovable property received by an individual or HUF, without consideration or as a gift, would be taxable in the hands of individual or HUF if:

Immovable property being Land or Building or both

Immovable property is a capital asset within the meaning of section 2(14) for such individual or HUF

Stamp duty value of such property is more than Rs 50,000/-

If above conditions are satisfied, then entire stamp duty value of the property would be taxable in the hand of Individual or HUF, under the head “Income from Other Sources”

Ex- Ms Aditi received a gift of flat from his friend. The stamp duty value of the flat is Rs 1,00,000/-

In this case flat is a capital asset in the hands of Ms Aditi, and stamp duty value of the flat is also above Rs 50,000/-, so full stamp duty value of flat ie. Rs 1,00,000/- would be taxable in the hand of Ms Aditi.

Fifth – Gift of Immovable Property received/acquired for less than its stamp duty value ie on inadequate consideration

Taxation

Immovable property received/acquired by an individual or HUF, for less than its stamp duty value ie on inadequate consideration, would be taxable in the hands of individual or HUF if:

Immovable property being Land or Building or both

Immovable property is a capital asset within the meaning of section 2(14) for such individual or HUF

Difference between Stamp duty value of such property and consideration paid is more than Rs 50,000/- and 10% of the consideration paid.

If above conditions are satisfied, then entire stamp duty value of the property would be taxable in the hand of Individual or HUF, under the head “Income from Other Sources”

Ex- Mr Reshu is a salaried employee, purchased a building from Mr. Deepak for Rs 25,20,000/-, the stamp duty value adopted by authority for that building was Rs 28,00,000/-. Now we need to advice Mr Reshu regarding the tax treatment in this case.

In the above case, building is a capital asset for Mr Reshu, and difference between stamp duty value and consideration is Rs 2,80,000/-, which is more than Rs 50,000/- and 10% of consideration ie Rs 2,52,000/-. So, in that case entire difference of Rs 2,80,000/- would be taxable in the hand of Mr Reshu

So, Friends that’s all about the Gift Tax in India, In case of any query or clarification, you may contact us.

We at Digi Accounto, always provides professional advice and support to our clients.

Choose Digi Accounto as your compliance partner as we are Accurate, Professional and Cost effective. ‘

Choose Digi – Karo Compliance Easy ‘

Thanks friends

Reshu Garg

Director

Accutech Digi Accounto Private Limited

Contact Us

+91 9953747282 | +91 8810409730

Info@digiaccounto.com | www.digiaccounto.com

Like, Subscribe and Follow us on

Facebook | Linkedin | Instagram | Youtube

We are at

Delhi | Gurgaon | Ghaziabad | Noida