All about Advance Tax | How to Deposit Advance Tax

Friends, have you deposited all of your Advance tax installments on time? Do you have complete knowledge about provisions related with Advance tax or you are not complying with advance tax provisions and paying unnecessary interest on your taxes because of not having complete knowledge of Advance Tax.

If yes and you want to know all about advance tax provisions then, you should read this article very carefully, we ensure you that… you will get answers of all your questions. After this you will be able to calculate your Advance tax accurately and will also be able to deposit it on time and you will be safe for paying unnecessary interest on late payment of advance tax.

In this Article, we will cover, provisions which will be helpful to accurate calculation of advance tax calculate and to deposit the same on time, such as:

If yes and you want to know all about advance tax provisions then, you should read this article very carefully, we ensure you that… you will get answers of all your questions. After this you will be able to calculate your Advance tax accurately and will also be able to deposit it on time and you will be safe for paying unnecessary interest on late payment of advance tax.

In this Article, we will cover, provisions which will be helpful to accurate calculation of advance tax calculate and to deposit the same on time, such as:

- What is advance tax

- Who is liable to pay advance tax

- What is the Due date for payment of advance tax

- How it can be calculated

- How we can pay it

- What if, we not paid or comply with Advance tax provisions

So friends we will discuss one by one …………

First of all…What is Advance Tax

Friends, you all are aware that, government collects taxes from us in two forms… one is direct tax and another is indirect tax…

Indirect tax is a tax which we all pay in many aspects, because it is collected with the consumption of any goods or services… we all are subjected with indirect tax such as GST, Excise, VAT , custom etc. It is Indirect because the person, who are actually paying it, is not aware about what amount of taxes he is paying to government.

Now, Direct tax is collected by government on income of the person, earned in any previous year… means to say… A person whatever earns in a year, he has to pay tax on it, this tax called Income Tax, and this income tax called direct tax, because we all know what we are paying to government. it is directly paid by person to government.

Friends, what we earn in a year, we can accurately know about it only after completing that year. If government wait for completion of full year and collect the taxes, then revenue coming from income taxes will be defer, because of which, government will not be able to run its welfare schemes and cannot comply other budgetary announcements due to non-availability of revenue on time.

So, what Government does…. Government divide this income tax in four installments and collect the same in the form of advance tax, so that funds can be reached to government at regular intervals and it will be easy for government to run the show.

This Income tax, which is collected in four installments, called Advance Tax.

Friends, it is necessary to accurate estimation of advance tax, and to deposit the same according to this accurate estimation. We will discuss further in this article, why it is?

Now we come to our second provision i.e., …. Who is liable to pay advance tax.

First of all…What is Advance Tax

Friends, you all are aware that, government collects taxes from us in two forms… one is direct tax and another is indirect tax…

Indirect tax is a tax which we all pay in many aspects, because it is collected with the consumption of any goods or services… we all are subjected with indirect tax such as GST, Excise, VAT , custom etc. It is Indirect because the person, who are actually paying it, is not aware about what amount of taxes he is paying to government.

Now, Direct tax is collected by government on income of the person, earned in any previous year… means to say… A person whatever earns in a year, he has to pay tax on it, this tax called Income Tax, and this income tax called direct tax, because we all know what we are paying to government. it is directly paid by person to government.

Friends, what we earn in a year, we can accurately know about it only after completing that year. If government wait for completion of full year and collect the taxes, then revenue coming from income taxes will be defer, because of which, government will not be able to run its welfare schemes and cannot comply other budgetary announcements due to non-availability of revenue on time.

So, what Government does…. Government divide this income tax in four installments and collect the same in the form of advance tax, so that funds can be reached to government at regular intervals and it will be easy for government to run the show.

This Income tax, which is collected in four installments, called Advance Tax.

Friends, it is necessary to accurate estimation of advance tax, and to deposit the same according to this accurate estimation. We will discuss further in this article, why it is?

Now we come to our second provision i.e., …. Who is liable to pay advance tax.

Friends according to Income Tax Act every person irrespective of his residential status, is liable to pay Advance tax except:

1. Whose Income Tax liability in a year is below Rs 10000/-

2. A resident whose age is 60 year or more at any time during the previous year and does not have any income chargeable under the head Profit and gains for business or professions.

Now we will discuss, Due dates for payment of advance tax

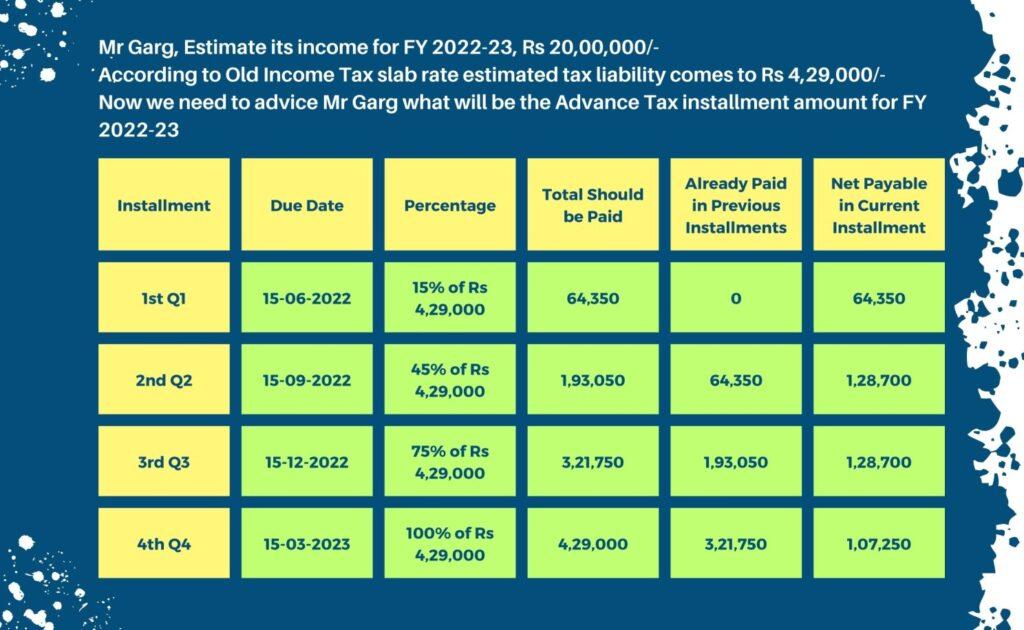

Friends, Government collects advance tax in 4 installments… Mean one due date for every quarter … so 4 due dates in a year. According to due date the person has to deposit a fix percentage of its Income tax through every installment. This percentage reached to 100% up to last installment. Accordingly due date with their fix percentage are as follows:

1. Whose Income Tax liability in a year is below Rs 10000/-

2. A resident whose age is 60 year or more at any time during the previous year and does not have any income chargeable under the head Profit and gains for business or professions.

Now we will discuss, Due dates for payment of advance tax

Friends, Government collects advance tax in 4 installments… Mean one due date for every quarter … so 4 due dates in a year. According to due date the person has to deposit a fix percentage of its Income tax through every installment. This percentage reached to 100% up to last installment. Accordingly due date with their fix percentage are as follows:

Due dates for advance tax is divided by government in 4 parts, so that government can get revenue at regular interval,

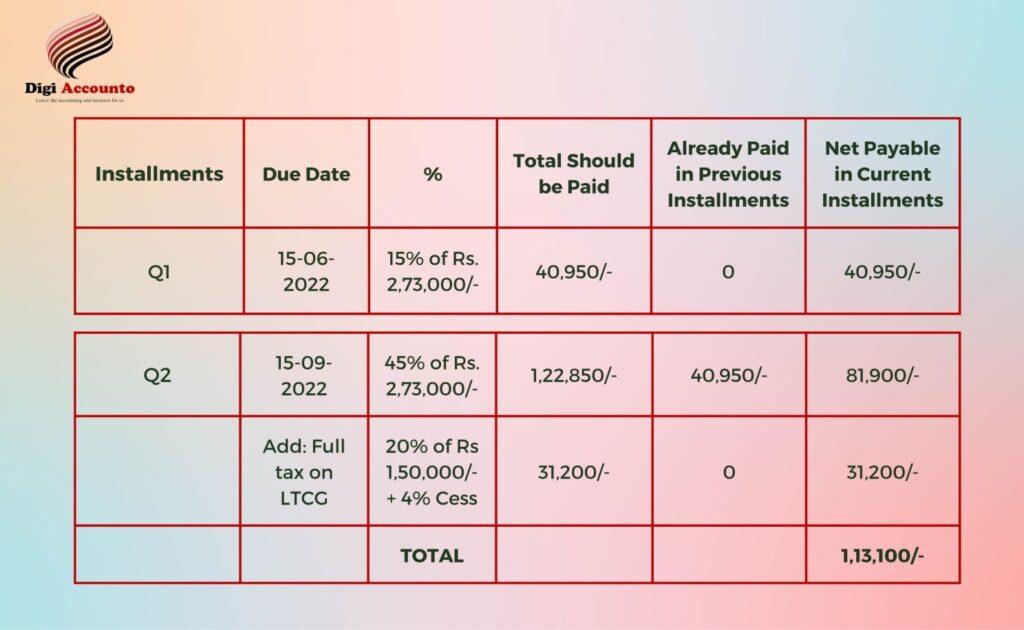

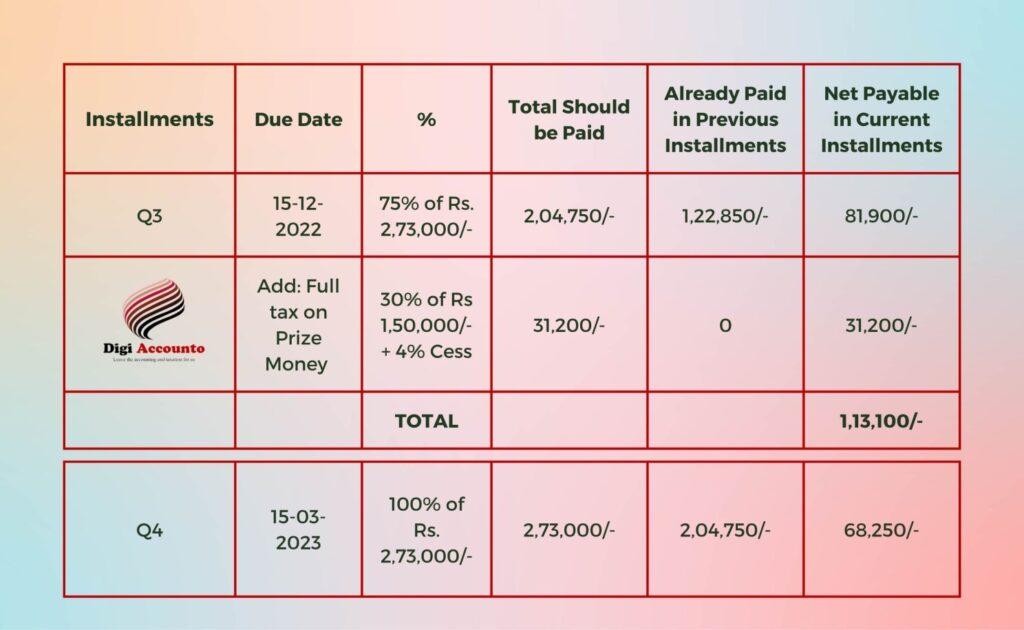

As you seen in table that, first installment will become due on 15th day of June month of Q1, In this installment a person has to deposit total 15% of its total estimated tax liability. After that, second installment will become due on 15th day of September month of Q2, up to this installment person has to deposit total 45% of its total estimated tax liability. Mean to say person has to pay additional 30% between 1st and 2nd installment, if he has already paid 15% in its first installment.

Accordingly, third installment will become due on 15th December up to which person has to paid total 75% of its estimated tax liability, means additional 30% in this installment, and 4th or last installment will become due on 15th March up to which person has to deposit 100% i.e. its full estimated tax liability.

Friends’ there are some more important point to be remembered. Such as…

The persons, who are filing their Income Tax Return under Section 44AD, and 44ADA i.e., under the provisions of presumptive taxation, will not be subjected with above said 4 installments. That persons will have to pay its 100% tax, in the form of advance tax on or before 15th march, means to say they can pay their advance tax in single installment, but on or before 15th March of the previous year.

Second In case of Income from capital gain, or any other income such as lottery income, income from sale of crypto, Income from winning from game shows etc, full income tax will be deposited as an advance tax in the same month, in which this income earned.

For Example, if a person sell its land in the month of September and get income, on this income, there is tax liability of Rs 1 Lacs, then, that person should have to pay its full tax liability of Rs 1 Lacs with in the month of September.

Now, We will discuss, How to Compute Advance Tax

Actual Income can be identified only after completion of particular year, but for calculation of advance tax, government make compulsory for person to estimate its income, which is going to happen in a particular year, and to deposit all its advance tax installments according to this estimation.

Here, while calculating estimated income, person need to consider that, every income which is going to be earned in current year, will compulsorily be part of this estimated income, because if any income skip to be part of this estimated income or if there are any income earn in any month which was not estimated by the person at the time of estimation, then that person need to pay additional interest on this. We will know about this interest in this article further.

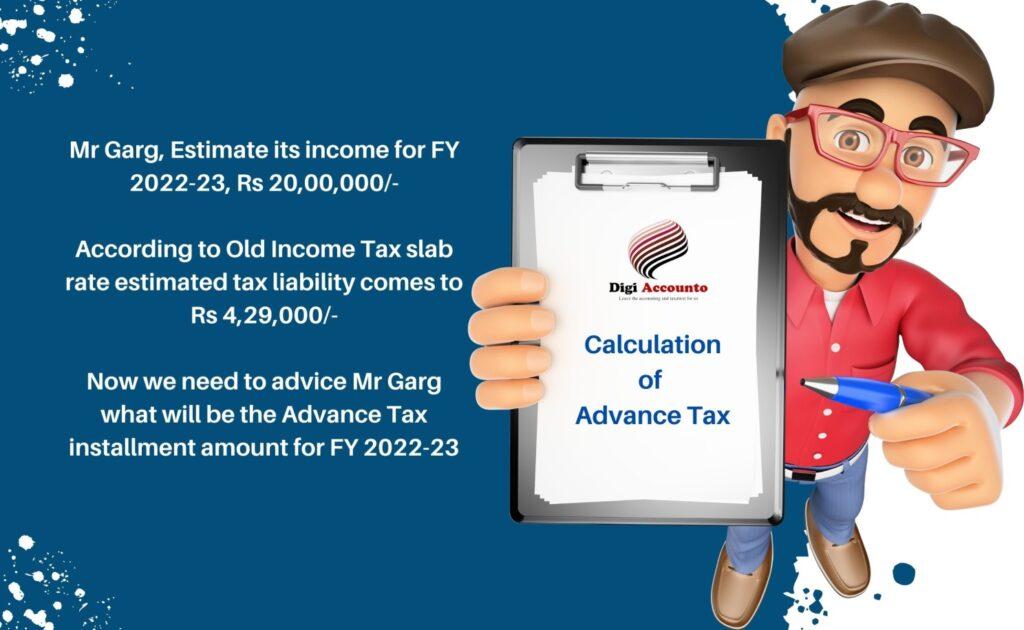

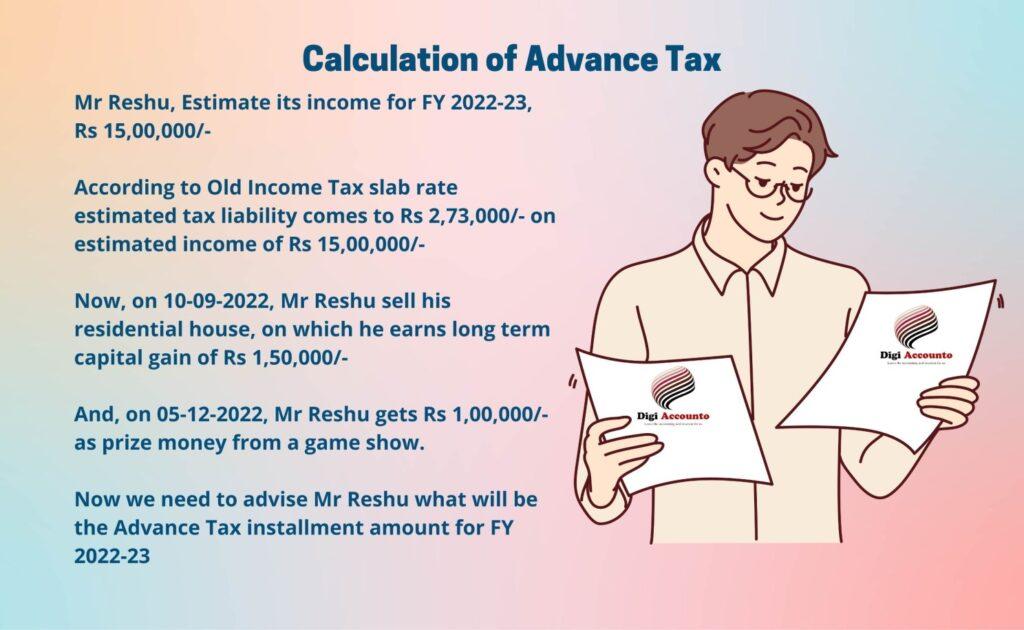

Now we will see the calculation of advance tax with the help of some examples, for clear understanding all calculation will be done according to Old tax scheme.

As you seen in table that, first installment will become due on 15th day of June month of Q1, In this installment a person has to deposit total 15% of its total estimated tax liability. After that, second installment will become due on 15th day of September month of Q2, up to this installment person has to deposit total 45% of its total estimated tax liability. Mean to say person has to pay additional 30% between 1st and 2nd installment, if he has already paid 15% in its first installment.

Accordingly, third installment will become due on 15th December up to which person has to paid total 75% of its estimated tax liability, means additional 30% in this installment, and 4th or last installment will become due on 15th March up to which person has to deposit 100% i.e. its full estimated tax liability.

Friends’ there are some more important point to be remembered. Such as…

The persons, who are filing their Income Tax Return under Section 44AD, and 44ADA i.e., under the provisions of presumptive taxation, will not be subjected with above said 4 installments. That persons will have to pay its 100% tax, in the form of advance tax on or before 15th march, means to say they can pay their advance tax in single installment, but on or before 15th March of the previous year.

Second In case of Income from capital gain, or any other income such as lottery income, income from sale of crypto, Income from winning from game shows etc, full income tax will be deposited as an advance tax in the same month, in which this income earned.

For Example, if a person sell its land in the month of September and get income, on this income, there is tax liability of Rs 1 Lacs, then, that person should have to pay its full tax liability of Rs 1 Lacs with in the month of September.

Now, We will discuss, How to Compute Advance Tax

Actual Income can be identified only after completion of particular year, but for calculation of advance tax, government make compulsory for person to estimate its income, which is going to happen in a particular year, and to deposit all its advance tax installments according to this estimation.

Here, while calculating estimated income, person need to consider that, every income which is going to be earned in current year, will compulsorily be part of this estimated income, because if any income skip to be part of this estimated income or if there are any income earn in any month which was not estimated by the person at the time of estimation, then that person need to pay additional interest on this. We will know about this interest in this article further.

Now we will see the calculation of advance tax with the help of some examples, for clear understanding all calculation will be done according to Old tax scheme.

Example 1

Example 2

Now, We will know, How to Pay Advance Tax

Advance tax can be paid through online facility by submitting the details in Challan No 280

Now, Consequences of default in payment of advance tax

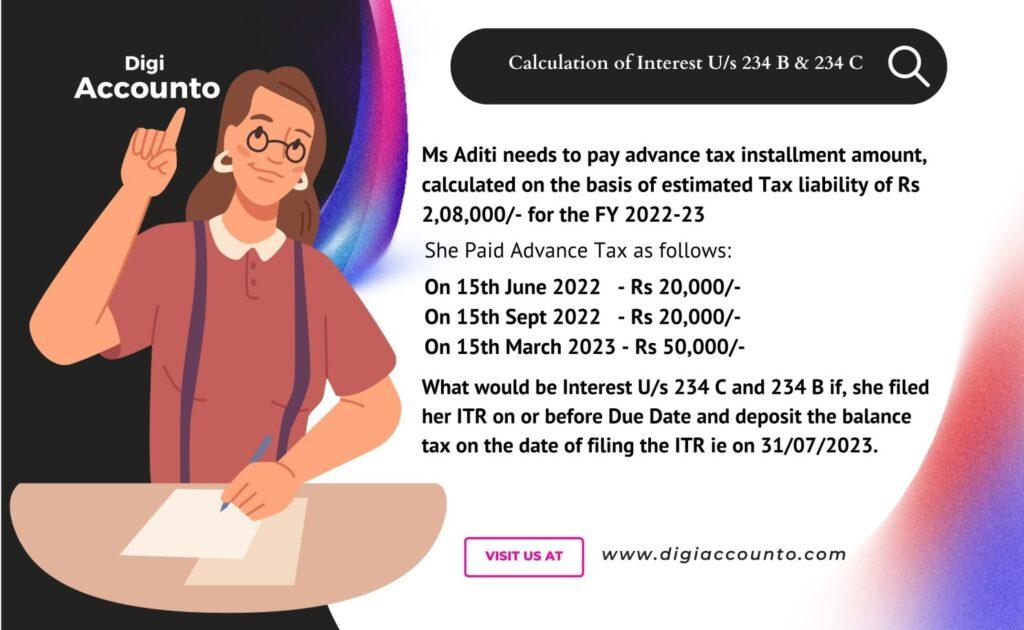

If a person does not comply with provisions of advance tax, and does not deposit advance tax instalments on time, then Interest under section 234B and 234C will be charged.

And friends, interest rate will be 1% per month of tax liability not paid.

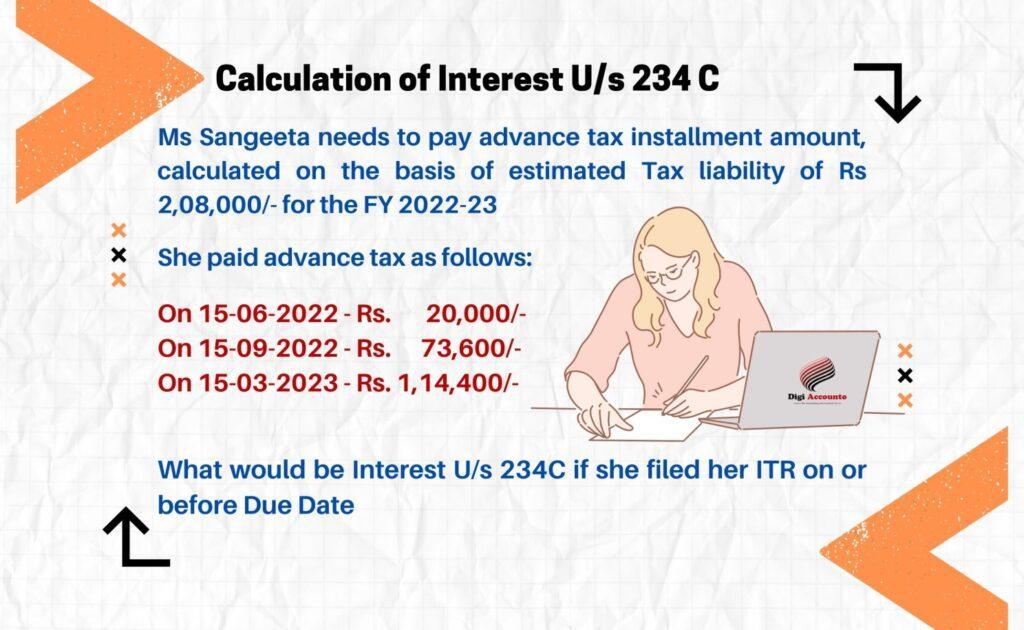

First, we will understand section 234C, Under Sec 234C, 1% monthly interest will be charged in case of default in payment of advance tax instalment by a person. Interest Under Sec 234C will be charged up to March month of the financial year only. If any tax is still payable then Sec 234B will come to in picture. Sec 234B we will see after Sec 234C

For clear understanding of calculation, we will take some example

Advance tax can be paid through online facility by submitting the details in Challan No 280

Now, Consequences of default in payment of advance tax

If a person does not comply with provisions of advance tax, and does not deposit advance tax instalments on time, then Interest under section 234B and 234C will be charged.

And friends, interest rate will be 1% per month of tax liability not paid.

First, we will understand section 234C, Under Sec 234C, 1% monthly interest will be charged in case of default in payment of advance tax instalment by a person. Interest Under Sec 234C will be charged up to March month of the financial year only. If any tax is still payable then Sec 234B will come to in picture. Sec 234B we will see after Sec 234C

For clear understanding of calculation, we will take some example

Example

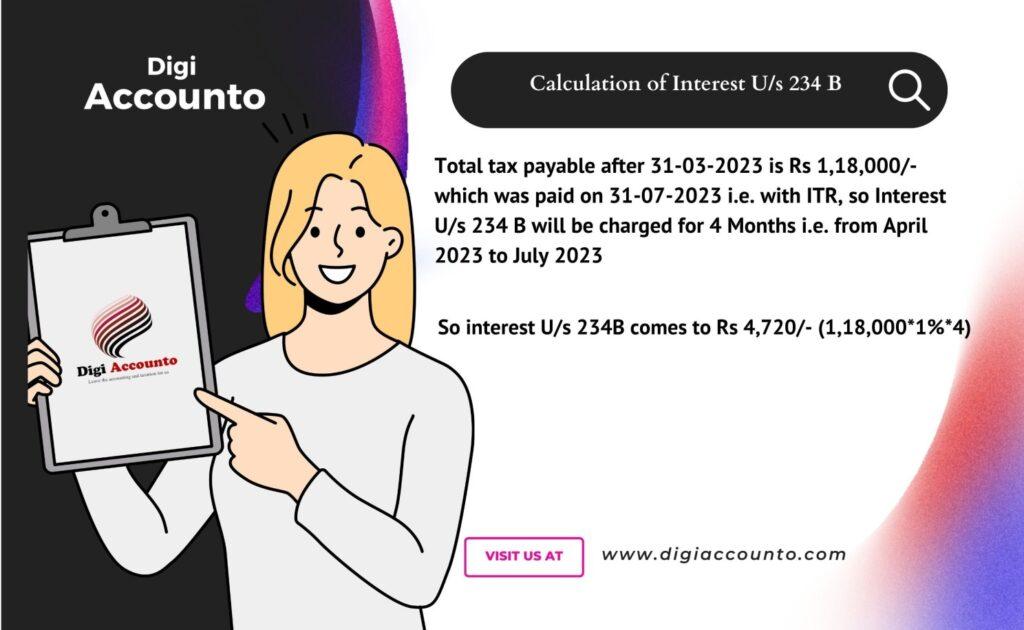

Now, we come to Sec 234B,

According to Sec 234B, if a person paid advance tax in a particular financial year and it is less than 90% of his total tax liability then, that person would be liable to pay interest under section 234B @ 1% per month from 1 April for the following such financial year till the date of deposit the total tax liability.

According to Sec 234B, if a person paid advance tax in a particular financial year and it is less than 90% of his total tax liability then, that person would be liable to pay interest under section 234B @ 1% per month from 1 April for the following such financial year till the date of deposit the total tax liability.

For Example

Calculation of Interest U/s 234B, 234C | Interest for not depositing Advance Tax | Interest U/s 234A, 234B, 234C | Example of Advance Tax | Due dates of Advance Tax | Advance Tax Installments | When to Pay Advance Tax | Who is Liable to Pay Advance Tax | All about Advance Tax | How to Deposit Advance Tax | क्या Advance Tax जमा करना Mandatory है | Digi Accounto | Business ATM

Calculation of Interest U/s 234B

Calculation of Interest U/s 234B

So, friends you observed that how non-compliance of advance tax provisions will lead to heavy interest, besides that, if income tax officer deems fit, that a person need to pay advance tax, then he may serve demand notice to such person in form 28, requiring him to pay the advance tax.. in this case that person required to pay advance tax and if he does not pay advance tax, in that case the person is deemed to be an assesses-in-default. Mean to say penalty proceeding can be initiated against that person.

So friends, right calculation of advance tax, and deposit advance tax in right installment is mandatory. otherwise, it leads to unnecessary litigation between person and income tax department.

So, friends keep in touch with us, we at Digi Accounto, will always try to cover topics like this, which will really be helpful for all of you…

Choose Digi – Karo Compliance Easy

Choose Digi Accounto as your compliance partner, As we are Accurate, Professional and Cost Effective.

Please Like, Share and Subscribe us at our social media platforms ……

Thanks friends, Thanks you all very much

So friends, right calculation of advance tax, and deposit advance tax in right installment is mandatory. otherwise, it leads to unnecessary litigation between person and income tax department.

So, friends keep in touch with us, we at Digi Accounto, will always try to cover topics like this, which will really be helpful for all of you…

Choose Digi – Karo Compliance Easy

Choose Digi Accounto as your compliance partner, As we are Accurate, Professional and Cost Effective.

Please Like, Share and Subscribe us at our social media platforms ……

Thanks friends, Thanks you all very much

Write a Comment