All About Section 194R | Section 194R क्या है | 194R क्यों महत्वपूर्ण है

TDS @ 10% on benefits or perquisites arising out of business or Profession

“Main Reason to Introduction is, to track the undeclared income.”

Applicability

So, to overcome this tax evasion, there were need of a tool to track the income and to bring it into tax channels.

Includes: Any Person for paying any benefit or perquisite to a resident dealer/customer.

Excludes: Individuals or HUF whose turnover does not exceeds 1 Crore (Business) or 50 Lacs (Profession) in preceding FY

What is Benefits/ Perquisites

Benefits or perquisites provided U/s 194R should be arising on account of business or profession.

Benefits may or may not be convertible into money but it should arise from business or profession.

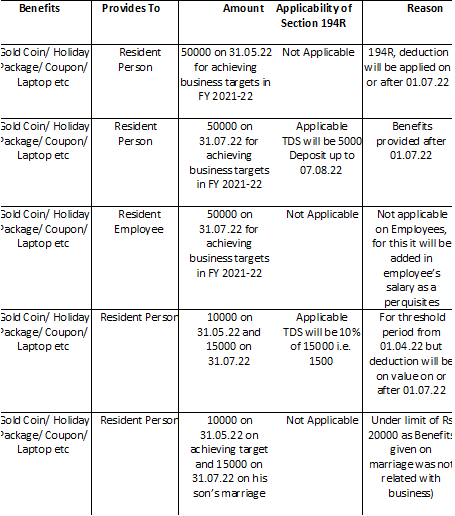

While TDS U/s 194R will be deducted only on the benefits or perquisites provided on or after 01st July 2022

M/s ABC Ltd/LLP/Firm/AOP/BOI/Trust/Society or Mr A (Individual/HUF) having turnover above Rupees 1 Crore (Business) or Rupees 50 Lacs (Profession) in PY 2021-22

Ans. It is clarified that no tax is required to be deducted on sale discount, cash discount and rebates allowed to customers – It is because sales discount, cash discount, or rebate allowed to customers from the listed retail price represents lesser realization of the sale price itself. To that extent purchase price of customer is also reduced.

Relaxation will not be applied on Free Samples – Free samples provided to resident dealer will be subjected with TDS U/s 194R, similarly, the above relaxation should not be extended to other benefits provided by the seller in connection with its sale. Some examples are

As the benefit/ perquisite are provided to the recipient entity, so tax is required to be deducted by the person in the name of recipient entity only- Because the usage by owner/director/employee/relatives is by virtue of their relation with the recipient entity only

1. Benefits provided after purchasing from somewhere else, then purchase value will be value of benefits

2. Product itself manufactured by the person, then the value charged by the customers for such item, will be the value of benefits.

GST will not be included for the purpose of valuation for Sec 194

1. New product launched

2. Discussion as to how the product is better than others

3. Obtaining orders from dealers/customers

4. Addressing queries of the dealers/customers

5. Reconciliation of accounts with dealers/customers

However, it must not be in the nature of incentive/benefit to select customers who have achieved particular targets

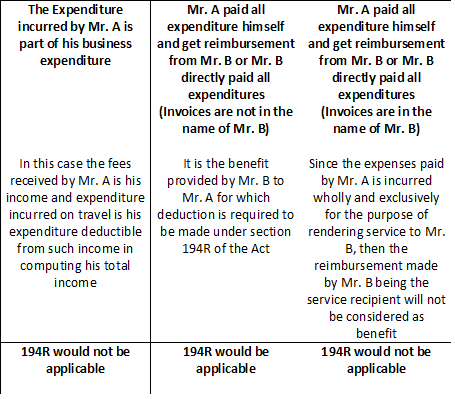

In below cases, the expenditure would be consider as benefit for the purpose of section 194R:

1. Expenses on Leisure trip or component, even if it is incidental to the dealer/business conference.

2. Expenditure incurred for family members accompanying the person attending dealer/business conference.

3. Expenditure on participants for days which are on account of prior stay or overstay beyond the dates of such conference.

Requirement – If a person is providing benefit in kind to a recipient and tax is required to be deducted U/s 194R, the person is required to ensure before releasing benefits that TDS has been paid by the recipient

How to ensure – Recipient would pay tax in the form of advance tax, and provide copy of challan along with a declaration to the person providing benefits.

Reporting by The Person providing benefits in its TDS Return- This would be required to be reported in TDS return along with challan number

Amendment in 26Q- This year Form 26Q has included provisions for reporting such transactions

Ans

For Calculation of Threshold of Rupees 20000 – Since, the threshold of Rupees 20000 is with respect to the FY, calculation of value or aggregate of the value of the benefits triggering deduction U/s 194R shall be counted from 01st April 2022

Deduction of TDS only on the benefits provided after 01st July 2022- The benefits which has been provided on or before 30th June 2022, would not be subjected to tax deduction U/s 194R of the Act.

So Friends, this is all about the newly inserted section 194R, hope you understand the intent of legislature and practical application of the section

THANK YOU

Write a Comment