Documents Under GST | Important Documents Prescribed Under GST | Tax Invoice | Bill of Supply | Credit & Debit Note Under GST

Hello Friends, welcome back to our Business Accounting and Taxation Mantra Series,

Friends in this article we will cover various documents, which we need to issue under GST Act. We will cover documents such as

– Tax invoice

– Credit/ Debit Note

– Bill of Supply

– Revised Tax invoice

– Contents of Revised tax Invoice

So, Friends we will explore it one by one, and requests that you all read this article carefully, so that you can get complete knowledge about the important documents required to maintain under GST Act.

First We will cover all about Tax Invoice

Friends first we will understand who will, at what time and in which format Tax invoice will be issue under GST

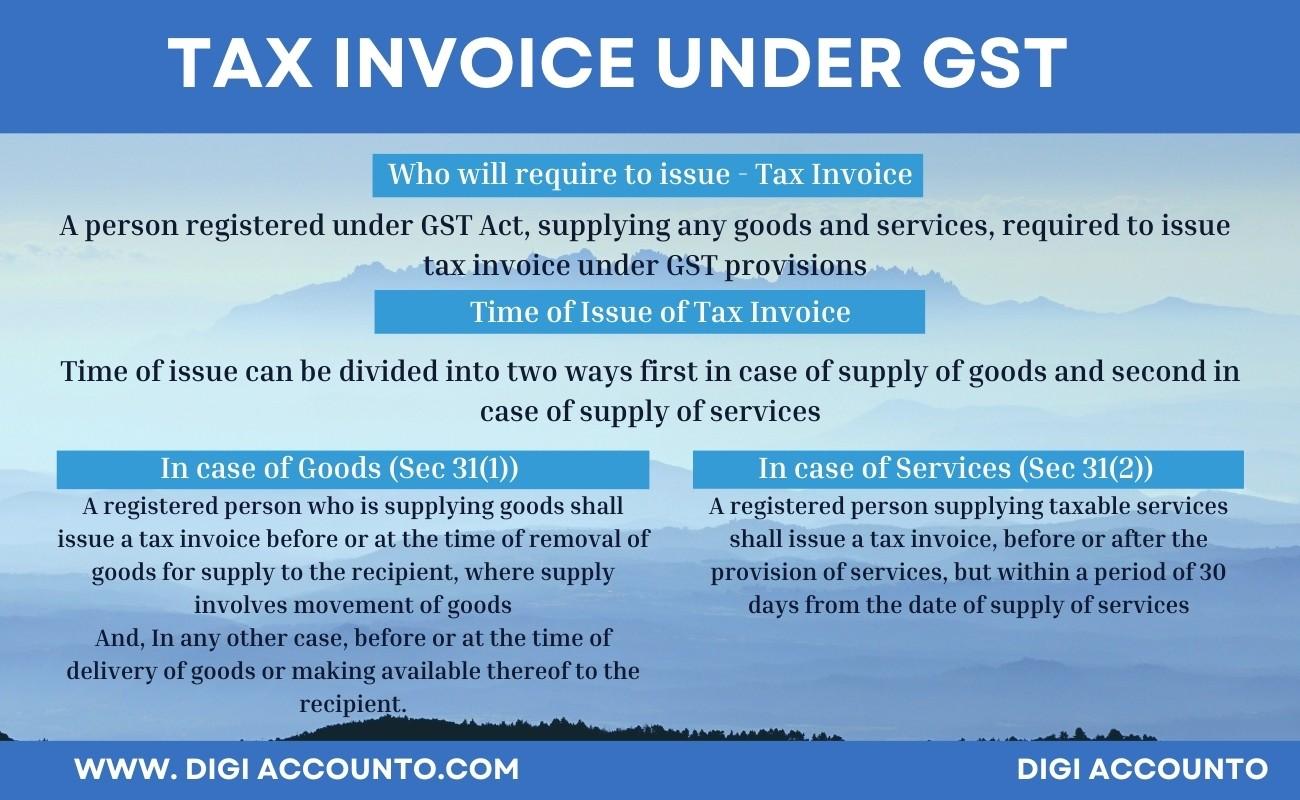

Who will required to issue

So, a person registered under GST Act, supply any goods and services, required to issue tax invoice under GST provisions.

Time of Issue of Tax-invoice

Friends, we have covered this provision in detail in our previous article named “time of supply under GST”

In continuation, time of issue can be divided into two ways first in case of supply of goods and second in case of supply of services

In case of Goods (Sec 31(1))

A registered person who are supplying goods shall issue a tax invoice before or at the time of –

a) Removal of goods for supply to the recipient, where the supply involves movement of goods

b) Delivery of goods or making available thereof to the recipient, in any other case

In Case of Services (Sec 31(2))

A registered person supplying taxable services shall issue a tax invoice, before or after the provision of services, but within a period of 30 days from the date of supply of services

Now, we will see in which manner and what we need to mention in Tax Invoice

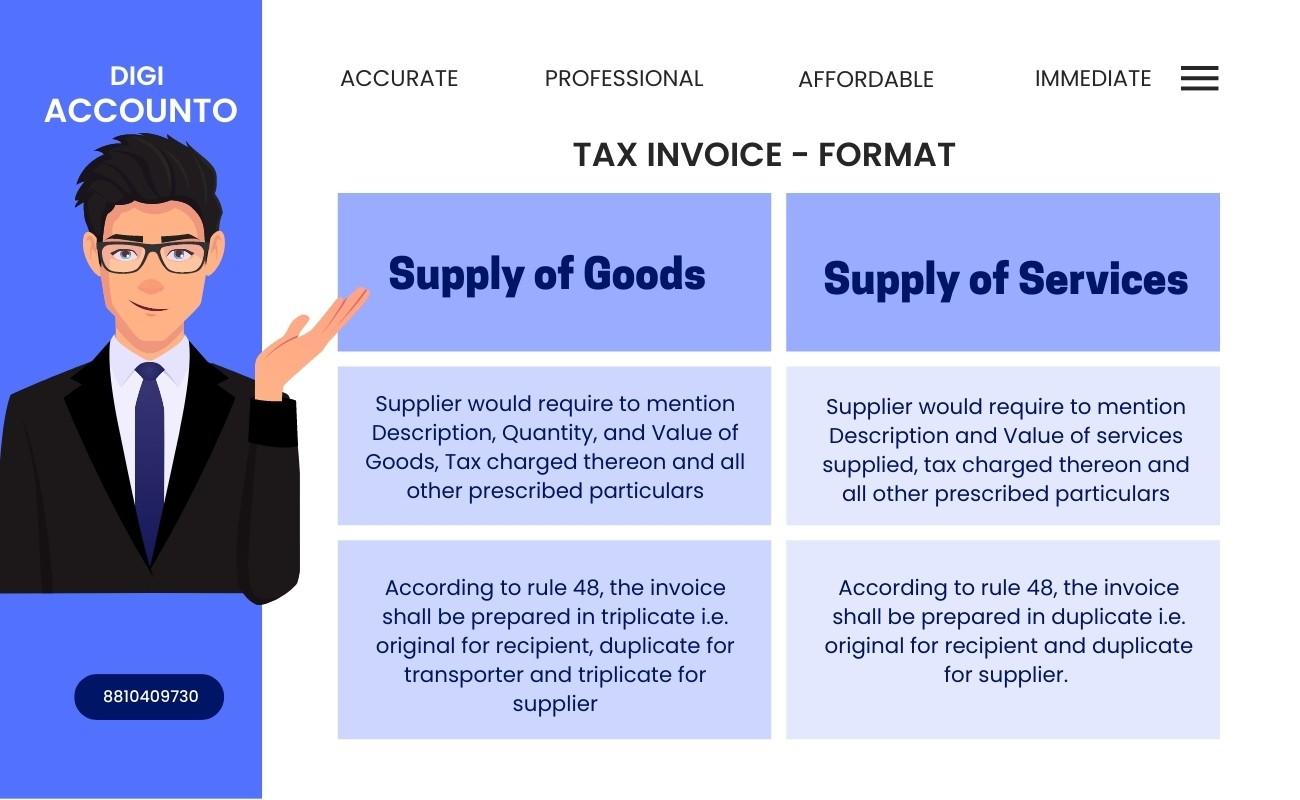

In case of Supply of Goods

Friends in case of supply of goods supplier would require to mention Description, quantity and value of goods, Tax charged thereon and all other prescribed particulars

According to Rule 48, in case of supply of goods, the invoice shall be prepared in triplicate ie original for recipient, duplicate for transporter and last Triplicate for supplier

In Case of Supply of Services

In case of Supply of Services supplier would require to mention Description and value of services supplied, tax charged thereon and all other prescribed particulars

According to Rule 48, in case of supply of services, the invoice shall be prepared in duplicate ie original for recipient, duplicate for supplier

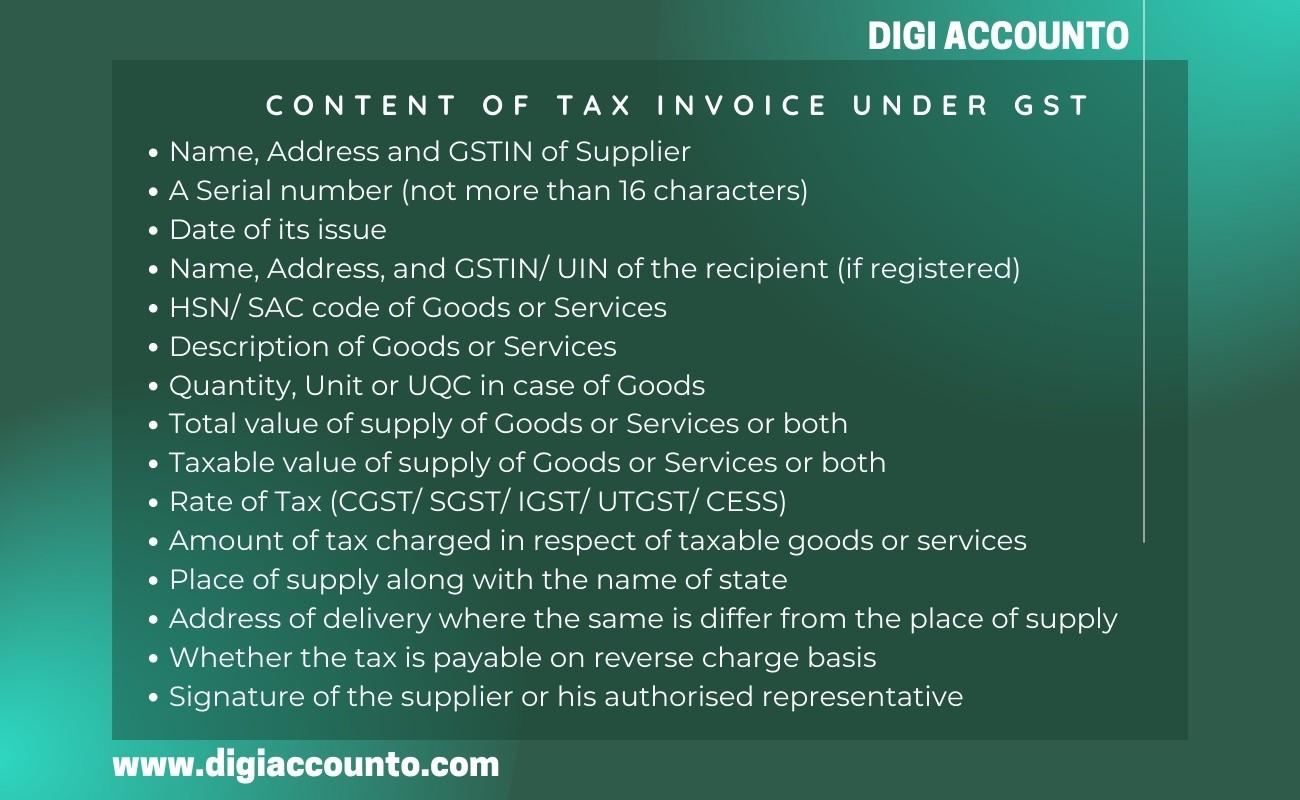

Now Friends comes to content of Tax Invoice

Friends GST act does not provide any specific format for Tax-Invoice, but there are some contents which should be mandatory mentioned over the tax invoice, such as

1. Name, Address and GSTIN of Supplier

2. A serial number, which should not be exceed 16 characters

3. Date of its issue

4. Name, Address and GSTIN or UIN of the recipient, if he is registered under GST

5. HSN code of Goods or Services

6. Description of goods or services

7. Quantity in case of goods and unit or Unique quantity code thereof

8. Total value of supply of goods or services or both

9. Taxable value of supply of goods or services or both

10. Rate of Tax (CGST/ SGST/ IGST/ UTGST/ CESS)

11. Amount of tax charged in respect of taxable goods or services

12. Place of supply along with the name of state

13. Address of delivery where the same is differ from the place of supply

14. Whether the tax is payable on reverse charge basis

15. Signature or digital signature of the supplier or his authorized representative.

Documents Under GST Important Documents Prescribed Under GST | What Records must be maintained under GST | Tax Invoice Under GST | Credit Note Under GST | Debit Note Under GST | Who will Tax Invoice Under GST | Time of Issue of Tax Invoice Under GST | Format of Tax Invoice | Content of Tax Invoice Under GST

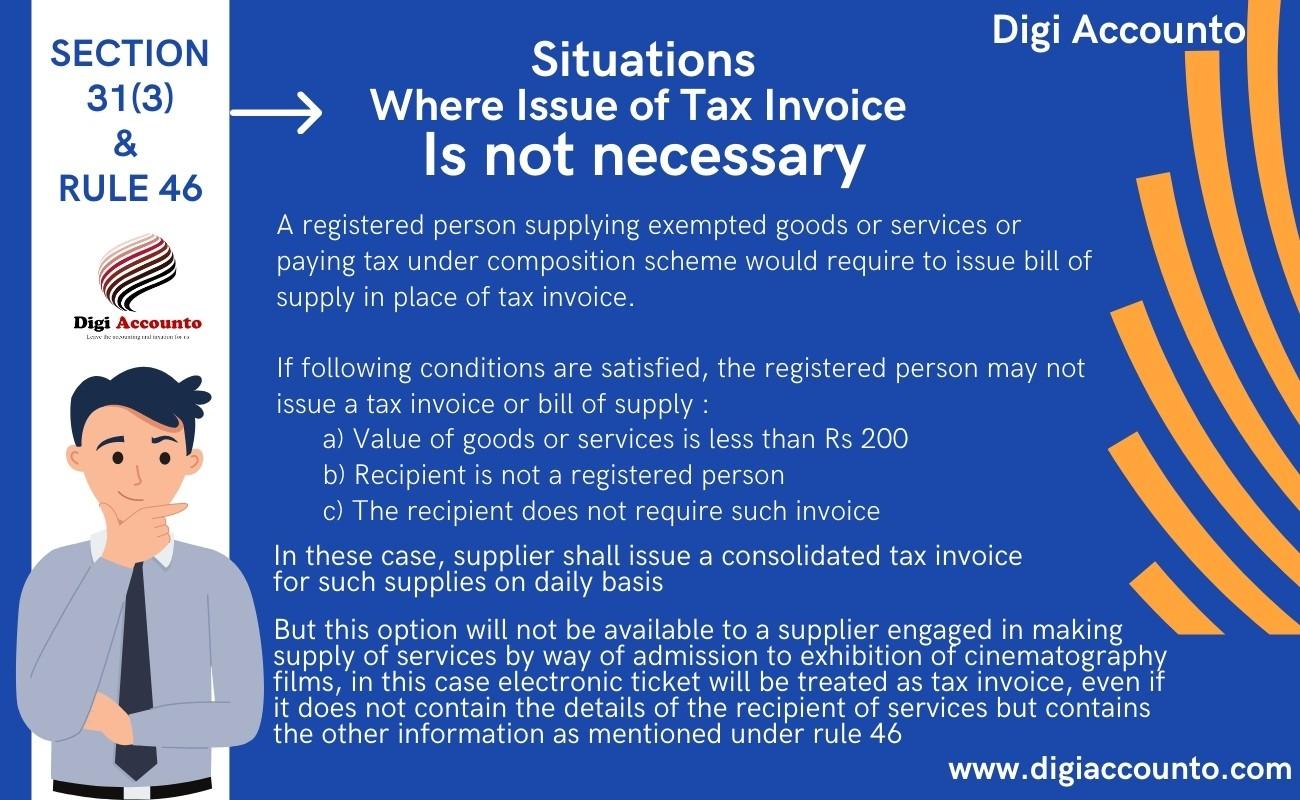

Situation where issue of tax invoice in not necessary

Friends As per Sec 31(3) and Rule 46, there are some situations, when issue of tax invoice is not necessary

1. A registered person supplying exempted goods or services or paying tax under composition scheme would require to issue bill of supply in place of Tax invoice

2. If following conditions are satisfied, the registered person may not issue a tax invoice or bill of supply

a) Value of goods or services supplied is less than Rs 200

b) Recipient is not a registered person

c) The recipient does not require such invoice

In the above case supplier shall issue a consolidated tax invoice for such supplies on daily basis

Documents Under GST Important Documents Prescribed Under GST | What Records must be maintained under GST | Tax Invoice Under GST | Credit Note Under GST | Debit Note Under GST | Who will Tax Invoice Under GST | Time of Issue of Tax Invoice Under GST | Format of Tax Invoice | Content of Tax Invoice Under GST | Situation where Tax Invoice is not mandatory to issue

But friends above option will not be available to a supplier engaged in making supply of services by way of admission to exhibition of cinematograph films, in this case electronic ticket which they provide to customer will be treated as tax invoice even if such ticket does not contain the details of the recipient of services but contains the other information as mentioned under rule 46

Friends that was about document Tax Invoice.

Now we come to another document ie

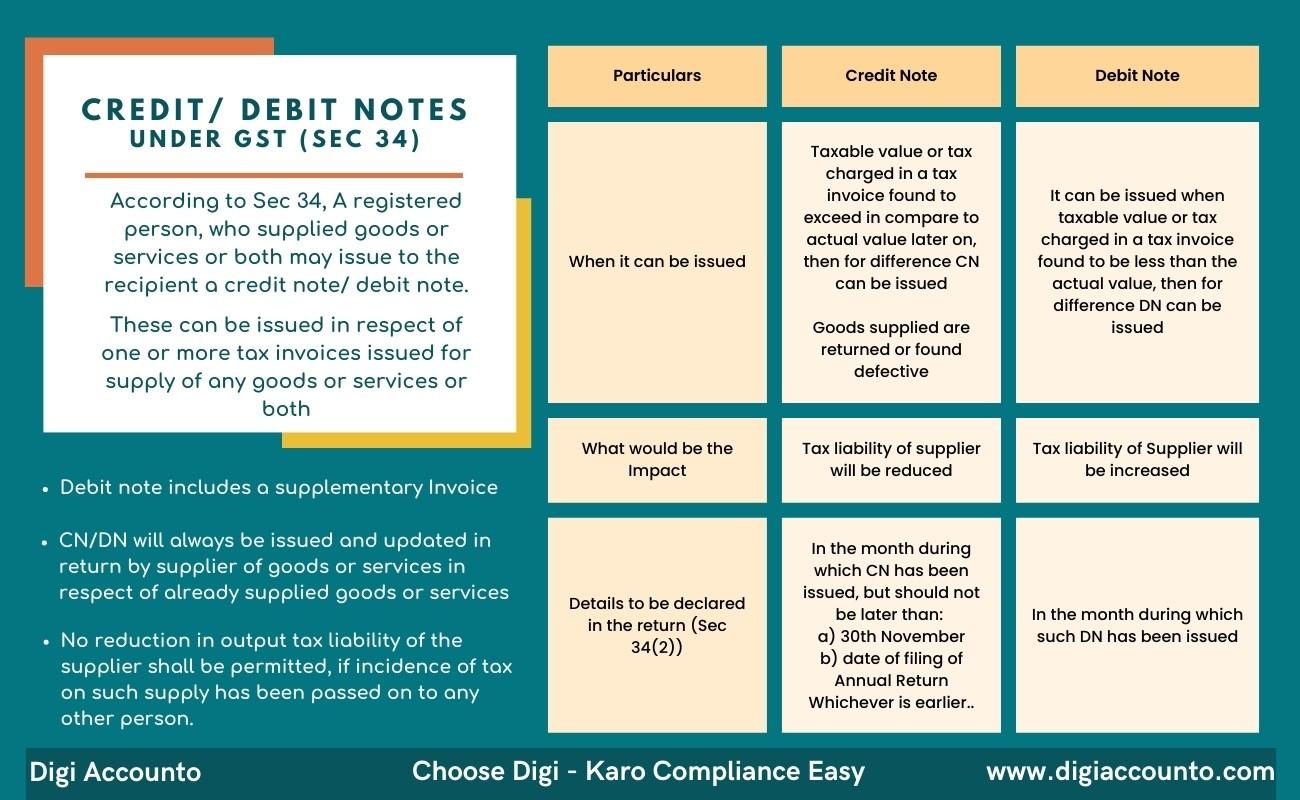

Credit and Debit Notes under GST (Sec 34)

Friends, According to Sec 34, A registered person, who supplied goods or services or both may issue to the recipient a Credit Note/ Debit Note. These can be issued in respect of one or more Tax invoices issued for supply of any goods or services or both.

Friends we will take it one by one

Documents Under GST Important Documents Prescribed Under GST | What Records must be maintained under GST | Tax Invoice Under GST | Credit Note Under GST | Debit Note Under GST | Who will Tax Invoice Under GST | Time of Issue of Tax Invoice Under GST | Format of Tax Invoice | Content of Tax Invoice Under GST

1.When it can be issue

Credit Note –

Friends in case of Credit Note, it can be issued when

a) Taxable value or tax charged in a tax invoice found to exceed in compare to actual value later on, then for difference CN can be issued

b) Goods supplied are returned by the recipient or

Goods/Services supplied are found to be deficient later on

Debit Note –

In case of Debit note, It can be issued when Taxable value or tax charged in a tax invoice found to be less than the actual value, then for difference DN can be issued.

2.What would be the Impact

Credit Note –

In case of Credit Note, Tax liability of supplier will be reduced

Debit Note –

But in case of Debit note, Tax liability of Supplier will be increase

3.Details to be declared in the return (Sec 34(2))

Credit Note –

Details of Credit note to be declared in the return for the month during which such credit note has been issued, but it should not be later than:

a) 30th November following the end of financial year in which such supply was made, or

b) The date of filing of the relevant annual return

Whichever is earlier

Debit Note –

Details of debit note to be declared in the return for the month during which such debit note has been issued

Friends here it is to be noted that, Debit note includes supplementary invoice and also one or more credit notes can be issued in respect of supplies made in a financial year without linking the same to individual invoices.

Credit/ Debit Notes will always be issued and updated in returns by suppler of goods or services in respect of already supplied goods or services.

Adjustment in tax liability on account of Debit/ Credit Note shall be made in the prescribed manner, but no reduction in output tax liability of the supplier shall be permitted, if the incidence of tax on such supply has been passed on to any other person.

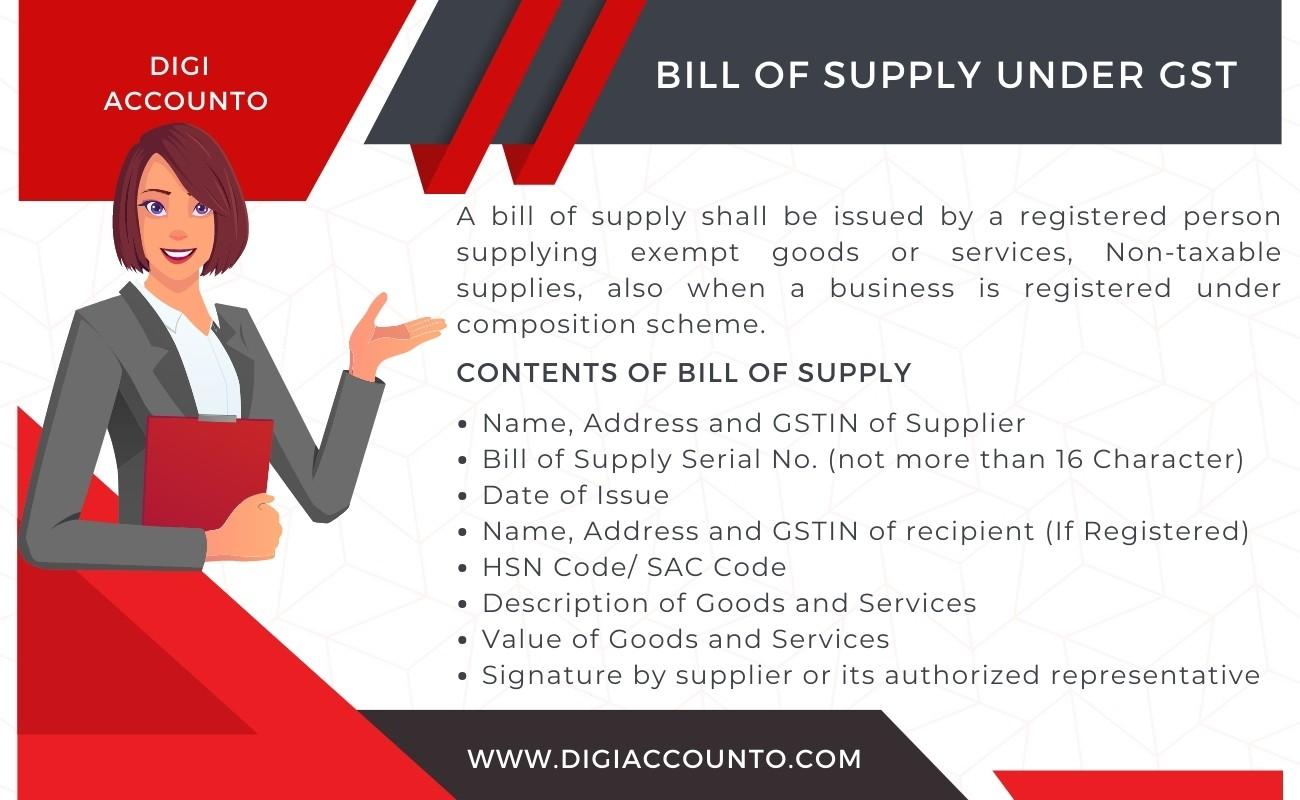

Friends, Third document we will cover is Bill of Supply under GST

A bill of supply shall be issued by a registered person supplying exempt goods or services, Non-taxable supplies, also when a business is registered under composition scheme, person shall issue only a bill of supply to its customers.

Contents of Bill of Supply

1. Name, Address and GSTIN of supplier

2. Bill of supply number (it shall not be exceeded 16 character)

3. Date of issue

4. Name, Address and GSTIN of recipient, GSTIN in case, recipient is registered

5. HSN Code/ SAC Code

6. Description of Goods and Services

7. Value of Goods & Services

8. Signature by supplier or its authorised representative

Now we come to our fourth document ie Revised Tax Invoice

Friends as you all know that, when our turnover exceeds the limit mentioned under GST act, we need to get compulsory registration. Now what if, when we cross that limit at one date and get the registration on another date, but with effect from the date when we crossed such turnover limit.

In that case, if we applied for GST registration within 30 days from the date of liability to get registration, then the certificate will show the date of liability as the date of effective registration.

Then that person, can issue revised tax invoice for all the invoices issued between the period from the date of liability to the date of granting registration certificate.

Now, we see example for clear understanding

Contents of Revised Tax Invoice

Documents Under GST Important Documents Prescribed Under GST | What Records must be maintained under GST | Tax Invoice Under GST | Credit Note Under GST | Debit Note Under GST | Who will Tax Invoice Under GST | Time of Issue of Tax Invoice Under GST | Format of Tax Invoice | Bill of Supply under GST | Contents of Bill of Supply under GST | Revised Tax Invoice under GST

Friends, A revised tax invoice shall contain the following particulars

1. The word revised tax invoice shall be indicated

2. Name, Address and GSTIN of the supplier

3. A serial number

4. Date of issue

5. Name, Address and GSTIN of recipient (GSTIN when, recipient is registered)

6. HSN/SAC

7. Serial number and date of the corresponding tax invoice/ bill of supply

8. Signature by supplier or its authorised representative

So, friends, we have covered main documents, which one need to maintain under GST Act, there are some more documents mentioned under GST Act such as, Receipt voucher, Payment Voucher, Refund Voucher, delivery challan etc. we will cover all other documents in our continuing business ATM series.

So, friends like share and subscribe us at our social media platform, so that all articles, videos and knowledge can directly reach to your inbox.

And if you have any query or suggestion, so please mention in comment section

Choose Digi Accounto as your compliance partner as we are Accurate, professional and cost effective.

Choose Digi Karo Compliance Easy

Thanks friends thanks you very much