ITR U | How to File ITR U | ITR File Kaise Kare 2022-23 | Filing of ITR-U

Our current topic is ITR-U ie filing of updated Income Tax Return

What If! You forgot to file your Income Tax Return…or you have skipped some income to report in your filed Income Tax Return and due date for filing of revised return has also been lapsed.

You have an option of ITR-U now,

ITR-U means an updated ITR

You can file ITR-U, but you cannot file ITR-U in following situation

1. For reporting any Loss

2. For reducing the total tax liability declared earlier

3. For filing return showing any new refund or increase earlier refund

4. Person against which any search and survey has been initiated

Now Comes to Due date for filing ITR-U

CBDT clarified in its notification that, a taxpayer can file ITR-U from AY 2020-21…

As per section 139(8A), ITR-U can be filed within 24 months from the end of the relevant assessment year.

We can try to understand it through an example…

For FY 2021-22 for which AY will be 2022-23, Tax payer can file ITR-U within 24 month from 31.03.2023, so due date will be 31.03.2025

One more thing we need to be noted that, Taxpayer can file ITR-U only when then time limit to file original ITR u/s 139(1), Revised ITR U/s 139(5) and Belated ITR U/s 139(4) has been lapsed.

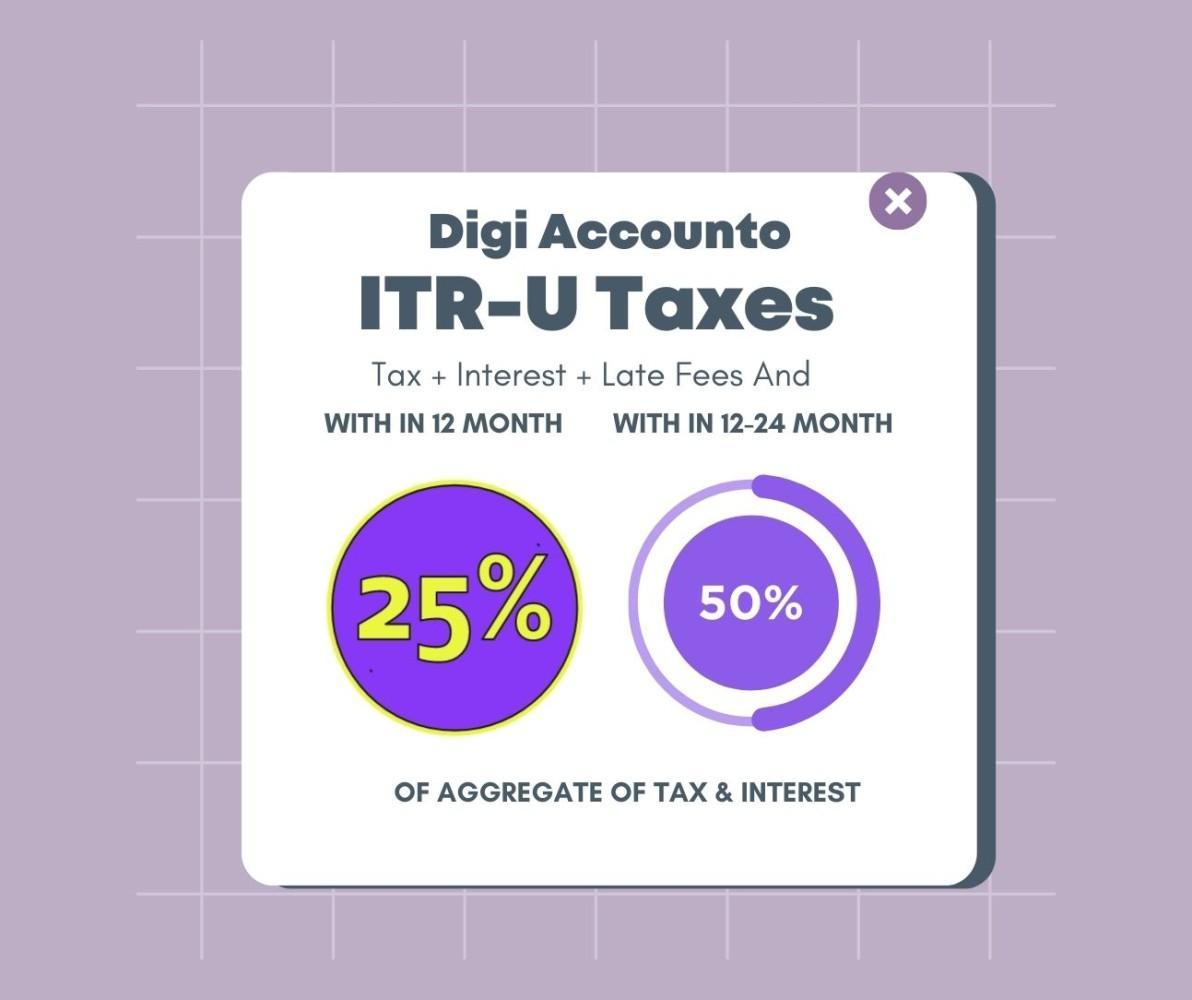

What you need to pay additionally for filing ITR-U

1. Tax due with Interest under section 234A, 234B and 234C

2. Late fees under section 234F

3. Additional tax –

Now, Additional tax can be divided in 2 parts

If ITR-U filed between last date of filing revised or belated ITR and expiry of 12 months from the end of AY then 25% of the aggregate of tax and interest (Before expiry of 12 months from end of AY)

IF ITR-U filed after expiry of 12 months and but before completion of 24 months from the end of relevant AY then 50% of the aggregate of tax and interest (After 12 but before expiry of 24 months from end of AY)

Here, we will consider that, taxpayer can claim Advance tax, TDS, TCS or relief under IT act against calculated liabilities.

So friend that all about ITR-U…

In case you required any support to file ITR-U or You have any other query you can contact us.

Choose digi accounto as your compliance partner, we are accurate, Professional and cost effective.

Write a Comment