Managing Accounts In-House or Outsource

To become a successful business owner you need to take care of changing environment and strategy of business world. You must have detailed analysis of your accounting and business transaction depending upon the industry to which you belong. You need to ensure, be compliant with required statutory rules and regulations, create budget and future forecasting, and filling of all legal reports and statement on time. This will bring your business towards profit.

All this can only be achieve through a well maintained books of accounts. Proper maintenance and Management of books of accounts make you accountable towards all the stakeholders of the business like the government, management, investors, and employees.

There are two way to manage your accounting and business transaction, either by setting up your own account department ie in-house accounts team, or by outsourcing to external accounting firm. When deciding from said two option, you need to take care about some points, such as:

All this can only be achieve through a well maintained books of accounts. Proper maintenance and Management of books of accounts make you accountable towards all the stakeholders of the business like the government, management, investors, and employees.

There are two way to manage your accounting and business transaction, either by setting up your own account department ie in-house accounts team, or by outsourcing to external accounting firm. When deciding from said two option, you need to take care about some points, such as:

In-House Accounts Team Vs Outsourced Accounting firm

Experience

Whether In-house accounts team or outsourced accounting firm, both should be completely aware about their business domain well. Most of the business man does not have good accounting background, so they required an experienced and professional accounting resource to manage the business transactions.

For start-ups it’s not easy to set up an experienced or professional in-house accounts team, because of limited availability of funds and resources. On the other hand outsourcing of accounts would enable them to manage their all business transactions through a team of highly experienced and professional team.

When you outsource your accounting needs, you don’t need to spend time on training. The firms have experienced accountants for different accounting needs, and they can start working almost immediately. There are both cost and time benefits to consider in the in-house accountant vs outsourced accounting decision.

For start-ups it’s not easy to set up an experienced or professional in-house accounts team, because of limited availability of funds and resources. On the other hand outsourcing of accounts would enable them to manage their all business transactions through a team of highly experienced and professional team.

When you outsource your accounting needs, you don’t need to spend time on training. The firms have experienced accountants for different accounting needs, and they can start working almost immediately. There are both cost and time benefits to consider in the in-house accountant vs outsourced accounting decision.

Data Security and Risk Associated

With a limited number of internal accountants controlling your finances, you are at greater risk of honest mistakes and intentional fraud. These accountants have complete access to your financial reporting and banking. When the number of people involved is more, and there are greater checks, the possibility of fraud is minimized.

When it comes to outsourcing your accounting, the reputation of the accounting firm is at stake. This means higher accountability and streamlining of the process to ensure that your accounts are accurate and risk free.

When it comes to outsourcing your accounting, the reputation of the accounting firm is at stake. This means higher accountability and streamlining of the process to ensure that your accounts are accurate and risk free.

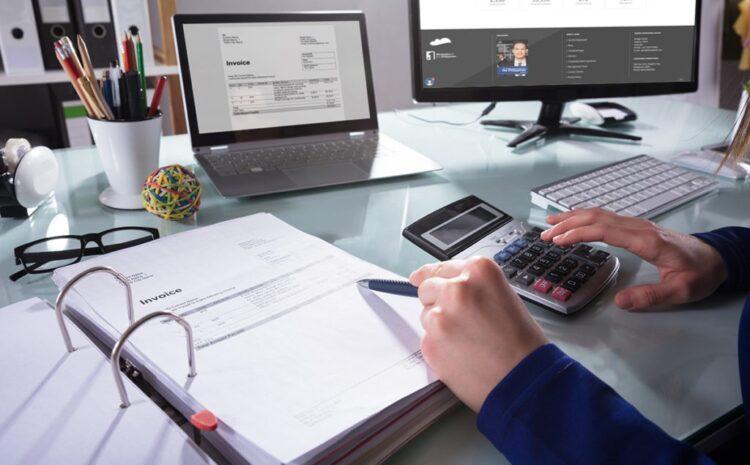

Attention level

Accounting covers many areas such as data entry, preparing invoices, clearing bills, managing accounts receivables, bank and card reconciliations, and preparation of various financial and business reports. It will not always be possible for In-house accountant to manage all the things together, there are high chance of errors in preparation of critical business reports. For this sometime business have to pay a heavy price.

When you outsource your accounting function, the firm takes care of the important financial reporting issues, and your in-house resources can concentrate on their other responsibilities. The productivity of your internal staff increases by outsourcing.

When you outsource your accounting function, the firm takes care of the important financial reporting issues, and your in-house resources can concentrate on their other responsibilities. The productivity of your internal staff increases by outsourcing.

Cost Factor

When you hire an in-house accountant and bookkeeper, you have two employees on your payroll and need to factor in all the costs involved. Apart from their remuneration, they will have to be paid full employment benefits. Don’t forget overheads like payroll taxes, health insurance, paid time off, on boarding costs, and contribution to retirement plans.

When you outsource your accounting functions, you pay a fix fee for the period of the contract but don’t need to pay any employee benefits or bear the overhead costs. If you have a small firm, your fee would cover cost of one in house accountant only. If you compare the costs, the outsourcing cost is much lower.

If you have complex accounting requirements, the fee would be considerably higher, but the benefits in terms of compliance and minimization of errors would far outweigh the costs.

When you outsource your accounting functions, you pay a fix fee for the period of the contract but don’t need to pay any employee benefits or bear the overhead costs. If you have a small firm, your fee would cover cost of one in house accountant only. If you compare the costs, the outsourcing cost is much lower.

If you have complex accounting requirements, the fee would be considerably higher, but the benefits in terms of compliance and minimization of errors would far outweigh the costs.

Write a Comment