Place of Supply | Supply of Goods | GST Law

Hello Friends, Welcome to all of you at our page, we are committed to deliver extreme knowledge about general topic in relation to Accounting and Taxation compliance matters. Today we will cover in this Business ATM series topic “Place of Supply under GST”

Friends first we need to know that, why it is important to understand “Place of Supply under GST Act” to better compliance of GST Act.

Friends you noticed that, divides GST liability under three different heads, under some invoice we charge CGST and SGST and under some we charge IGST, but have you ever thought, how it decides, what need to charge whether CGST, SGST or IG

So, it’s totally depending only on place of supply, you know if place of supply is in the same state, within which you are registered then, CGST and SGST will be applicable and if it is in different state or outside India then IGST will be applicable.

Place of supply provisions are covered under IGST Act 2017, Section 10, 11, 12 and 13, which covers determination of place of supply in various situations or transactions.

For clear understanding we divide our Article in two parts one is Place of Supply in case of Supply of Goods and second is Place of Supply in case of Supply of Services.

Section 10 and 11 of IGST Act 2017 covers the Provision of Place of Supply in case of Supply of Goods while Section 12 and 13 covers Provisions of Place of Supply in case of Supply of Services

Further Section 10 covers Provision of Place of supply in case of Supply of Goods other than imported into India and Exported outside India.

While Section 11 covers Provision of Place of Supply in case of Supply of Goods Imported into or exported outside India.

So we will take it one by one in deep

Section 10: Provisions for Place of Supply in case of supply of Goods within India

Friends as you know supply can be of many types but GST Acts provides clear provisions for supplies such as supply involving movement of goods, supply not involving movement of goods, supply involving bill to ship to transaction, supply of goods assembled or installed at site, supply of goods on board a conveyance

According to section 10 we will see what would be the time of supply in case of different supply situation

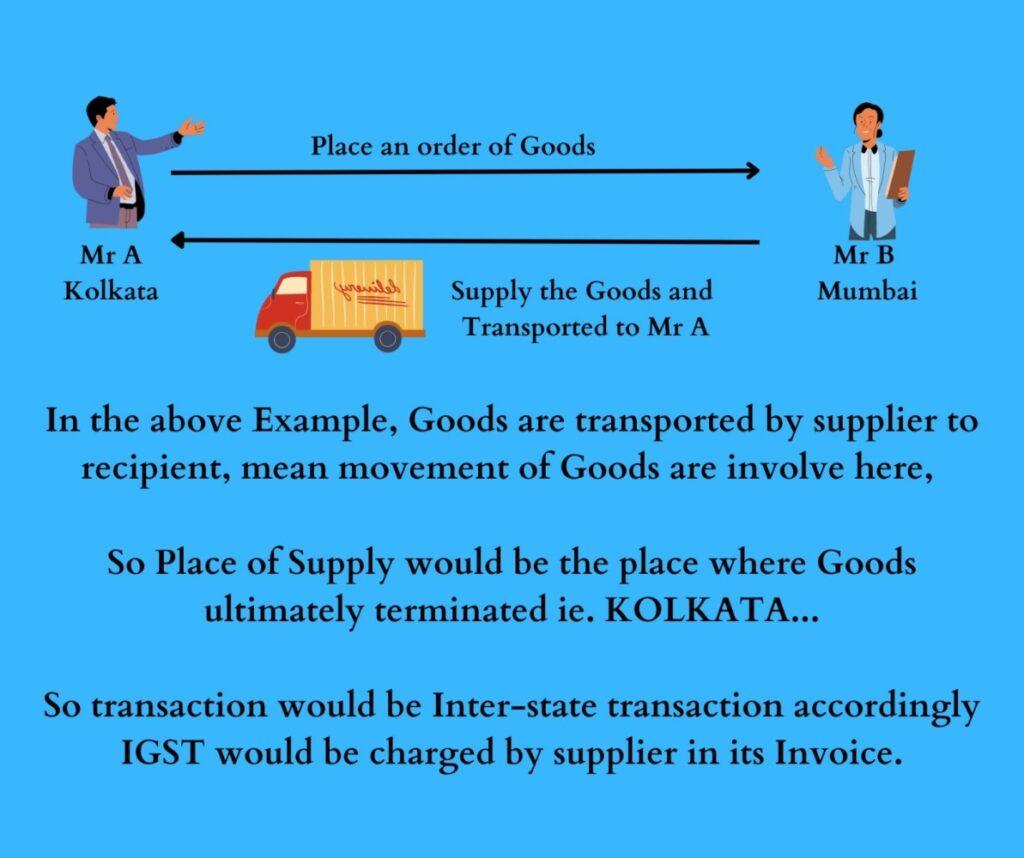

When supply of goods involving movement of goods

The place of supply shall be the location of the goods at the time at which the movement of goods terminate for delivery to the recipient

For Example:

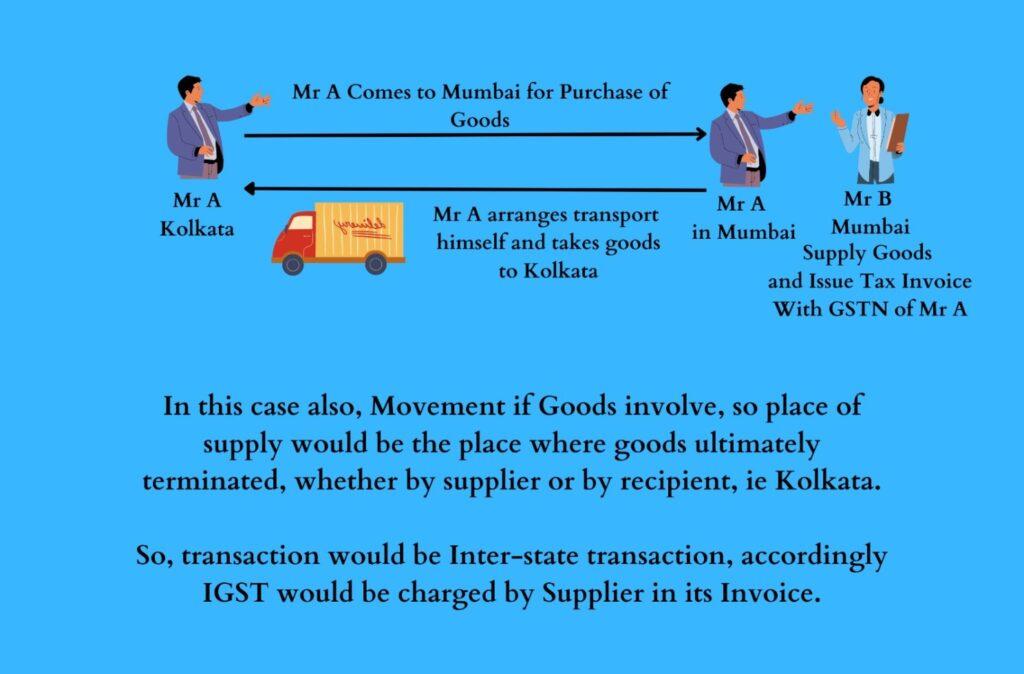

But one thing become important to note here that, Place of supply where movement of goods involve, we will only see whether movement of goods is required or not, it is not required to see movement is done by supplier or by recipient.

We take one Example for this

Suppose in previous example Mr A from Kolkata comes to Mr B at Mumbai, and purchases goods from Mr B in Mumbai itself, Mr B supply goods and Issue tax invoice with GSTN of Mr A, Now Mr A arranges transport himself and takes goods to Kolkata.

In this case also, movement of goods involve, so place of supply would be the place where goods ultimately terminated whether by supplier or by recipient, ie Kolkata. So, transaction would be Inter-state transaction, accordingly IGST would be charged by supplier in its invoice.

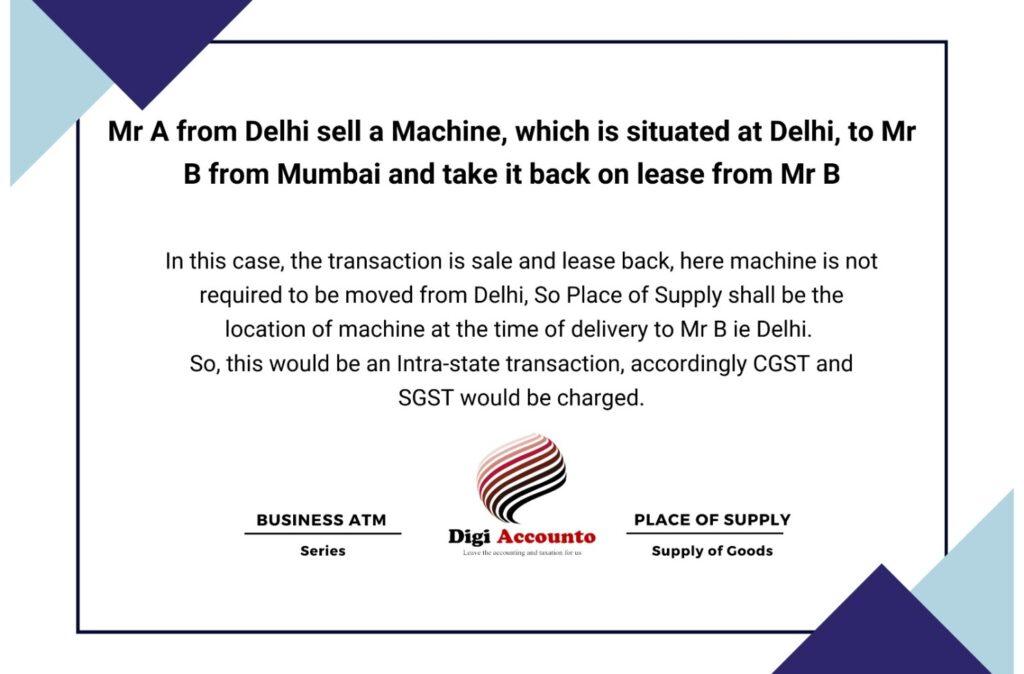

When supply of goods does not involve movement of goods

Now where supply of goods does not involve movement of goods, whether by supplier or by recipient, then Place of Supply shall be the location of such goods at the time of the delivery to the recipient.

For Example:

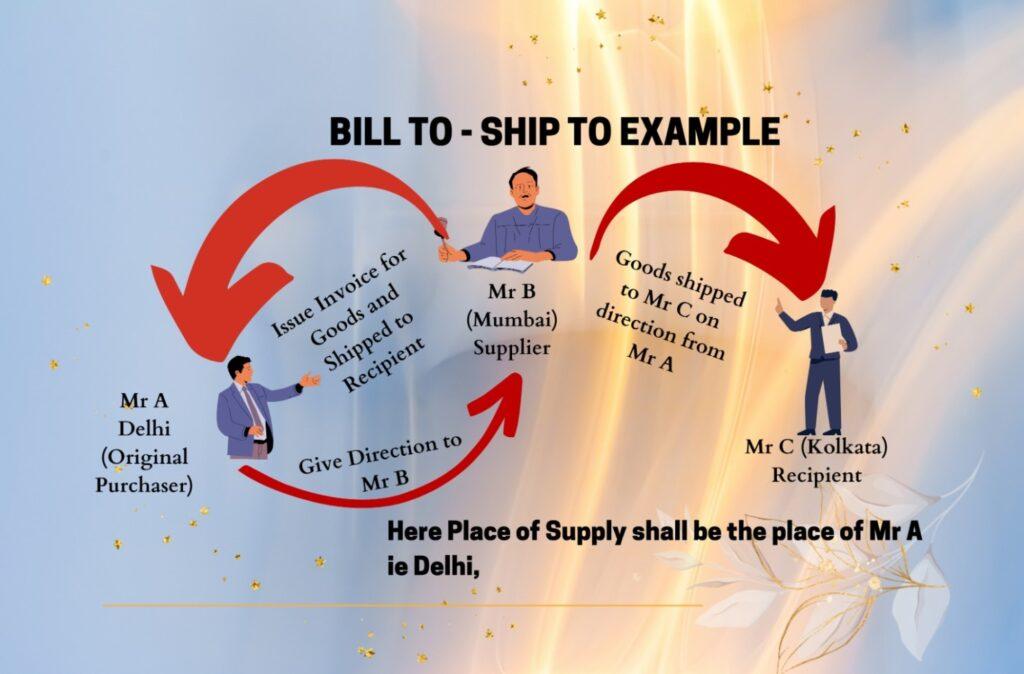

Now Place of Supply in case of Bill-to-ship to Transactions

First, we need to understand, what is this Bill-to-ship to Model?

Under this model, Supplier supply goods to recipient on the direction of another person.

Generally, there are Three Parties

First – Supplier who supply the goods

Second – Recipient, who received the goods

Third – Third person, who gives direction to supplier for supply

It involves two business transaction one is between supplier or third person and other is between recipient and third person, these type of models adopted generally to save transportation expenses and time.

In this case, Place of Supply shall be the place of the person who gives direction to the original supplier to transport the goods to recipient

For Example:

Mr A from Delhi, place an order for purchase of goods to Mr B at Mumbai, with a direction to transport the goods to Mr C at Kolkata.

Now in this example there are three parties-

Mr B – Supplier

Mr C – Recipient

Mr A – Third Person who gives direction to Mr B for transporting the goods

Here Place of supply shall be the place of Mr A ie Delhi, So Transaction would be Interstate, accordingly IGST would be charged.

Place of Supply where supply involves assembly and installation of Goods

In this case the place of supply shall be place of such installation or assembly.

Now comes to Section 11 ie

Place of Supply of Goods Imported into or exported from India

First Good Imported into India

Friends As per section 7 of IGST act, Good Imported into India will always be treated as Interstate supply, means on these supplies always IGST would be applicable. In case of Import of Goods, importer need to deposit IGST under reverse charge, which can be further adjusted against his future output liabilities.

Example:

Now, Place of Supply in case of goods imported into India shall be the location of Importer. However, we know, in any case on these supply IGST shall be charged, but Place of supply would be important to allocate the state share under IGST by central government.

For Example

In Previous Example the place of supply shall be the location of Mr A, ie Mumbai, So the state’s share of IGST will go to Maharashtra.

Now, second is Place of Supply in case of Goods exported outside India

Place of supply shall be the location outside India

Mean, In case of Export supplies always IGST will be applicable, further it is to be noted that for promoting export, government has covered export supplies under zero rated supplies. Mean to say if you are exporting goods outside India, against a LUT (Letter of Undertaking) then, you need not to pay IGST, but Place of Supply would always be the Place outside India.

So, friends these were the provisions, for Place of Supply in case of supply of Goods, we hope it provided you deep understanding of the topic.

Provisions, for Place of Supply in case of Supply of Services, we will cover in our next article, so friends keep connecting and reading.

Please like, share and subscribe us at our social media platforms

In case you required to suggest any topic to be covered, please comment in comment section, we will definitely cover the same.

Write a Comment