Taxation of Intra-day Share Trading Income

Taxation of Intra-day Share Trading Income

In continuation of our series of Business ATM i.e Business Accounting and Taxation Mantra, Our New topic is how to calculate profit, loss, turnover and how to access requirement of Tax audit in case of intra-day shares transactions.

Friends, Everyone want to be involved in share transactions, because number of platforms are available now to handle it… and also they are providing required support or infrastructure to individuals for doing the same.

You also and persons known to you would definitely be dealt with share transactions…

Friends, in today time the most famous share transactions are intraday share transactions mean to say transaction in which a contract for purchase or sale of any stock or shares is settled without actual delivery or transfers of the same.

Digi Accounto, Business Accounting & Taxation Mantra, Business ATM, Accounting Services, Share Trading, Intraday share trading taxation

But, have you ever thought about the treatment of profit and loss going to be arise over these transactions under Income Tax Act, wil it be taxable in Income Tax or not… or if it will Taxable then how?, Under which head of income it will be taxable?, Is there any Tax audit limit prescribed for it?, if yes then, how we need to calculated turnover for this.

We at team Digi Accounto will try to answer all questions under this article… So that you all can be able to understand and can comply all required rules and regulations in this regards…

So we will take it one by one ………..

Taxability of income from speculative business

Friends, As per Income Tax, Profit and Loss arising on intra-day shares transaction will be covered under Speculative Business mean to say this type of transactions called speculative business

Digi Accounto, Business Accounting & Taxation Mantra, Business ATM, Accounting Services, Share Trading, Intraday share trading taxation, Taxability of income from speculative business

Speculative business, is always taxable under the head named profit and gains from Business or Profession.

Income tax Act divides business income in two parts, one is from speculative business and another is from non-speculative business

There is no separate provision prescribed under Income Tax for taxability of Profit and Loss arise on Speculative business, it is computed in a same way as normal business. Means, it charged to tax at normal tax rates as applicable to person.

Now second question is …. Will tax audit be applicable on this … or whether is it required to get this business audit from a CA?

Digi Accounto, Business Accounting & Taxation Mantra, Business ATM, Accounting Services, Share Trading, Intraday share trading taxation, Taxability of income from speculative business, Tax Audit

Friends, because these transactions, are covered under profit and gains from business and profession head…. It means audit will definitely be applicable but only when turnover exceeds from prescribed limit.

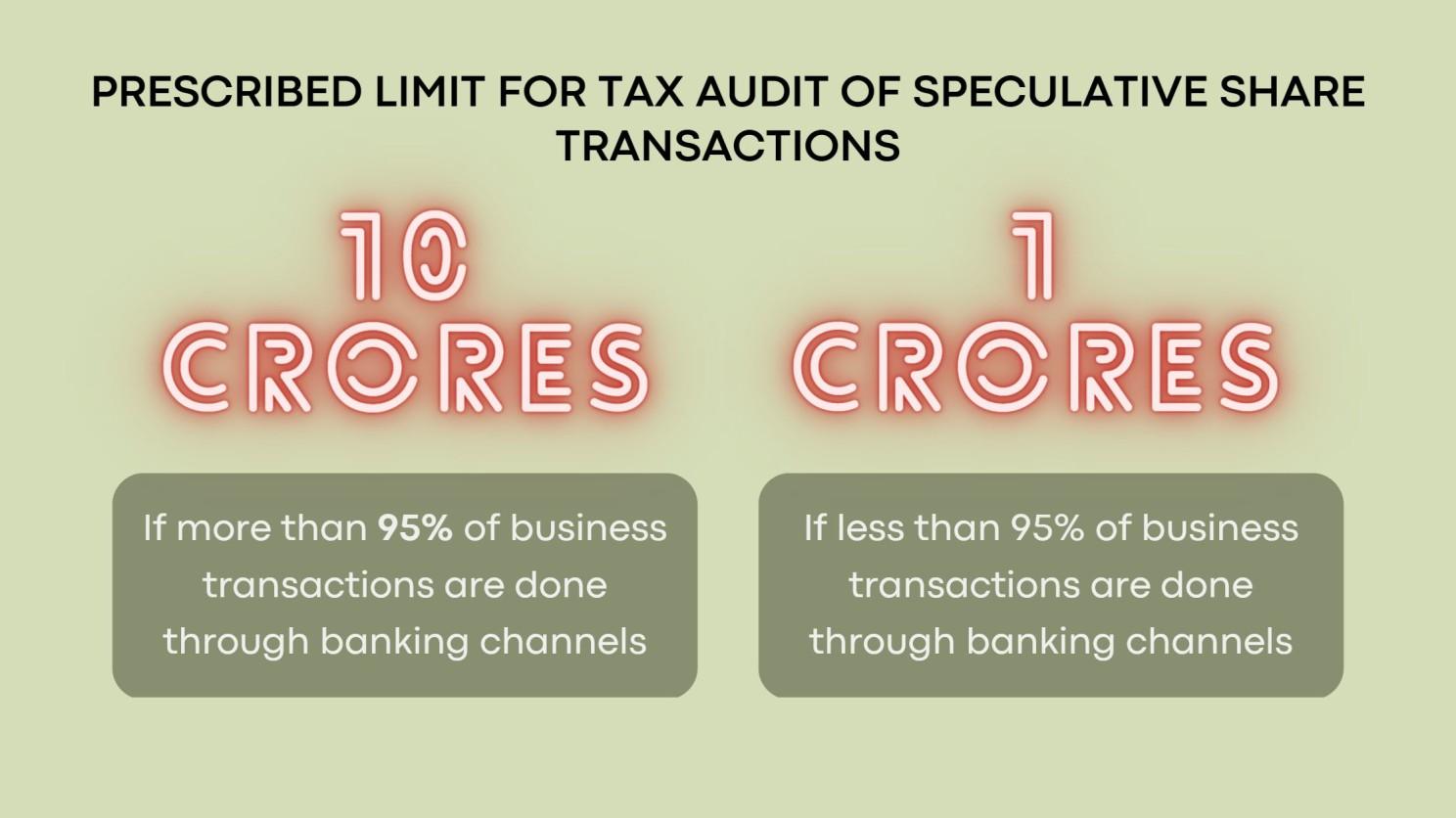

Now, what is this prescribed limit…? So it is 1 crore but there are one more provision exist in Income tax that if more than 95% of business transactions are done through banking channels then tax audit shall be required only when the amount of turnover exceeds Rs. 10 crores.

Digi Accounto, Business Accounting & Taxation Mantra, Business ATM, Accounting Services, Share Trading, Intraday share trading taxation, Taxability of income from speculative business, Tax Audit

And, In Intra-day trading almost all transactions are gone through banking channels….. So here turnover limit for tax audit will be Rs 10 Crores.

Now, you will question what this turnover mean and how it will be calculated…..?

Friends, the Income-tax Act does not contain any provision or guidance for computation of turnover in case of intra-day trading…. However in case of speculative transaction the method for determining turnover are prescribed under a guidance note issued by The Institute of Chartered Accountants of India…

Friends, you are fully aware that there can be profit or loss in speculative profit… for calculation of Turnover Profit or loss both will be treated as an independent transaction. Accordingly, the aggregate of both profit and loss is to be considered as the turnover.

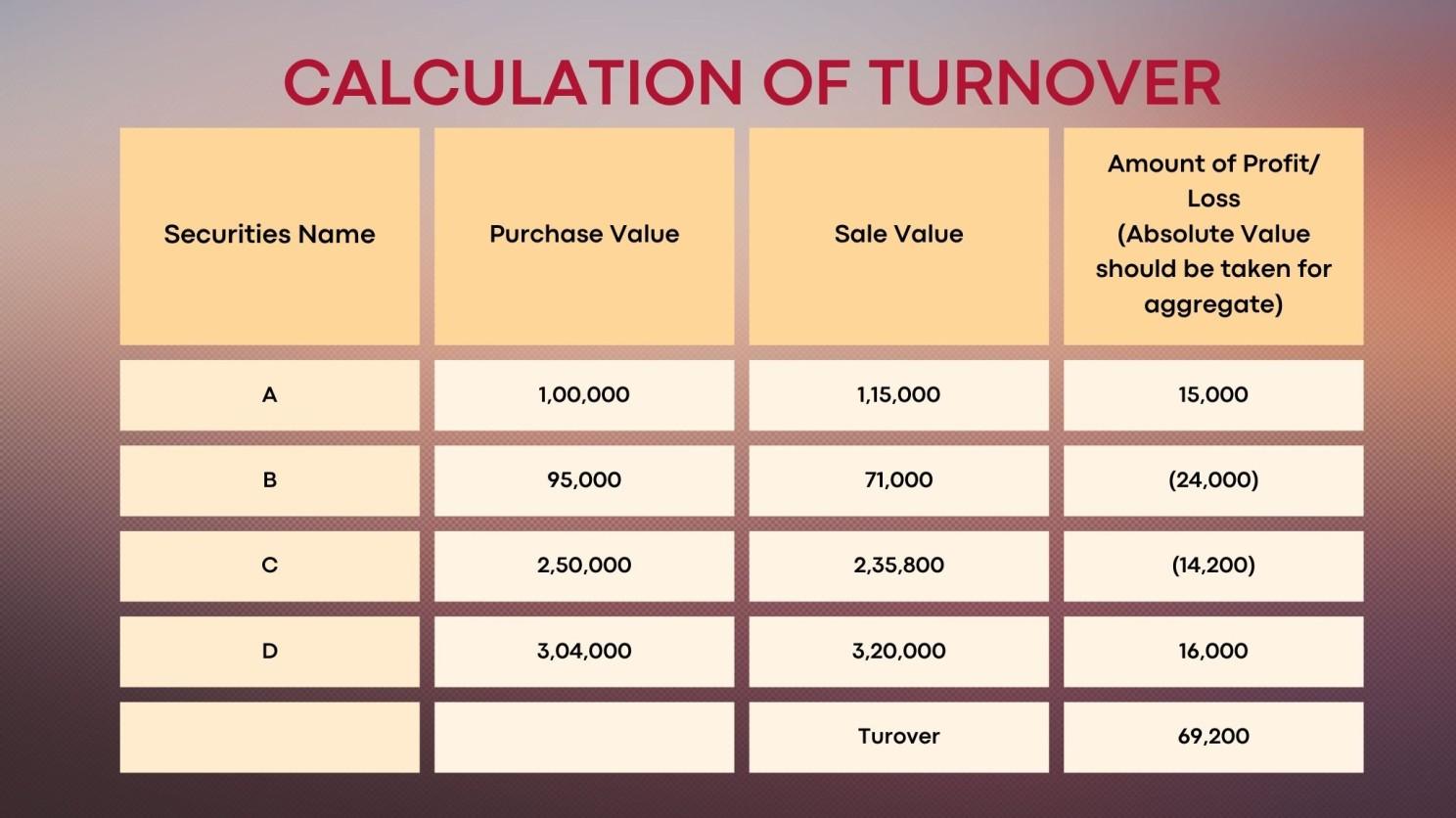

We can understand it with the help of an example…

Mr. X does the following intra-day trading of shares during the year:

Digi Accounto, Business Accounting & Taxation Mantra, Business ATM, Accounting Services, Share Trading, Intraday share trading taxation, Taxability of income from speculative business, Tax Audit, Turnover

Friend In the above example turnover will be the aggregate of Profit and loss ie 69,200/-

Here, it is to be noted if the amount of turnover exceeds the limit as prescribed (ie 1 crore/ 10 Crore) then Mr. X shall be liable to get his accounts audited.

One more thing need to state here that, Loss occurred on Intra-day trading cannot be set off against income earned any other head of Income… other head income means here, income from salary, house property, capital gains or other sources.

The losses from speculative business (i.e., loss from intra-day trading) can be set-off only against speculative profits (i.e., profit from intra-day trading). However, losses from a normal business can be adjusted against the profits of a speculative business.

Now, If in any year loss from Intra-day trading could not be fully adjusted against profit from Intra-day trading then it can be carry forward up to 4 subsequent assessment year for set off… but in these 4 years also it will only be set off against profits from speculative business.

It is important to note that….carry forward of losses will be allowed only if, You have filed your Income Tax Return on or before the due date prescribed for filing…..If such return is not filed within the prescribed due date, the right to carry forward and set-off is lost.

So friends, We hope that, Now you have completely understand the taxability of Intra-day share transactions and what rules and regulations you have to follow for that….

In case you required any support in this regards please contact us,

Choose Digi … Karo Compliance Easy

Please like and subscribe us for such regular mantra….

Choose digi accounto as your compliance partner as we are Accurate, Professional and cost effective…

Digi Accounto, Business Accounting & Taxation Mantra, Business ATM, Accounting Services, Share Trading, Intraday share trading taxation, Taxability of income from speculative business, Tax Audit, Turnover

Thanks friends thanks you very much

Write a Comment