Friends, it has been 6 years passed to introduced GST in India, but still there are so many provisions under GST Act, which are still unclear to a general accountant and businessman. Due to this unclarity, many times these businesses have to pay late fees and penalties.

Time of Supply is also one of the unclear provisions. many accountants and businessman are not able to identify at what time in a transaction GST liability would arise. Will it be arisen at the time of advance payment received against supply, or at dispatch of goods, or at the time of issuing of invoice or will it be at the receipt of complete payment against an invoice.

You know, correct answer of this question is compulsory for successfully comply with GST law, because we paid GST liability after determining wrong Time of Supply then it may be that, we need to pay interest on it… or sometime late fees as well as penalty also.

So, In this Business Accounting & Taxation mantra series (ie Business ATM), We at Digi Accounto will cover topic “Time of Supply” in all respect… so that it can be clear to all of you and from now for this you need not to pay late fees, penalty and interest.

So, friends let start…

GST law divides “Time of Supply” provisions into two parts. first is “Time of Supply of Goods” and second one is “Time of Supply of Services”

For clear understanding we will take one by one

First … time of supply of goods

Provision for time of supply of goods under forward charge mechanism ie when supplier is liable to pay GST

Friends, according to GST provisions, in case of supply of goods under forward charge mechanism, the time of supply will be at the earliest of the following three dates:

1. Date on which supplier issues invoice

2. If supplier does not issue invoice, then, the last date at which he required to issue invoice under GST law

3. Date at which supplier received the payment in respect of such supply

Friends but in 2017 me GST department has issued one notification, according to which in case of supply of goods, GST liability would not be arise on advance payment received from recipient of goods. Notification number was 66/2017- Central tax dated on 15-11-2017

So accordingly, time of supply in case of supply of goods now, would be the earliest of these two ie.

1. Date on which supplier issues invoice

2. If supplier does not issue invoice, then, the last date at which he required to issue invoice under GST law

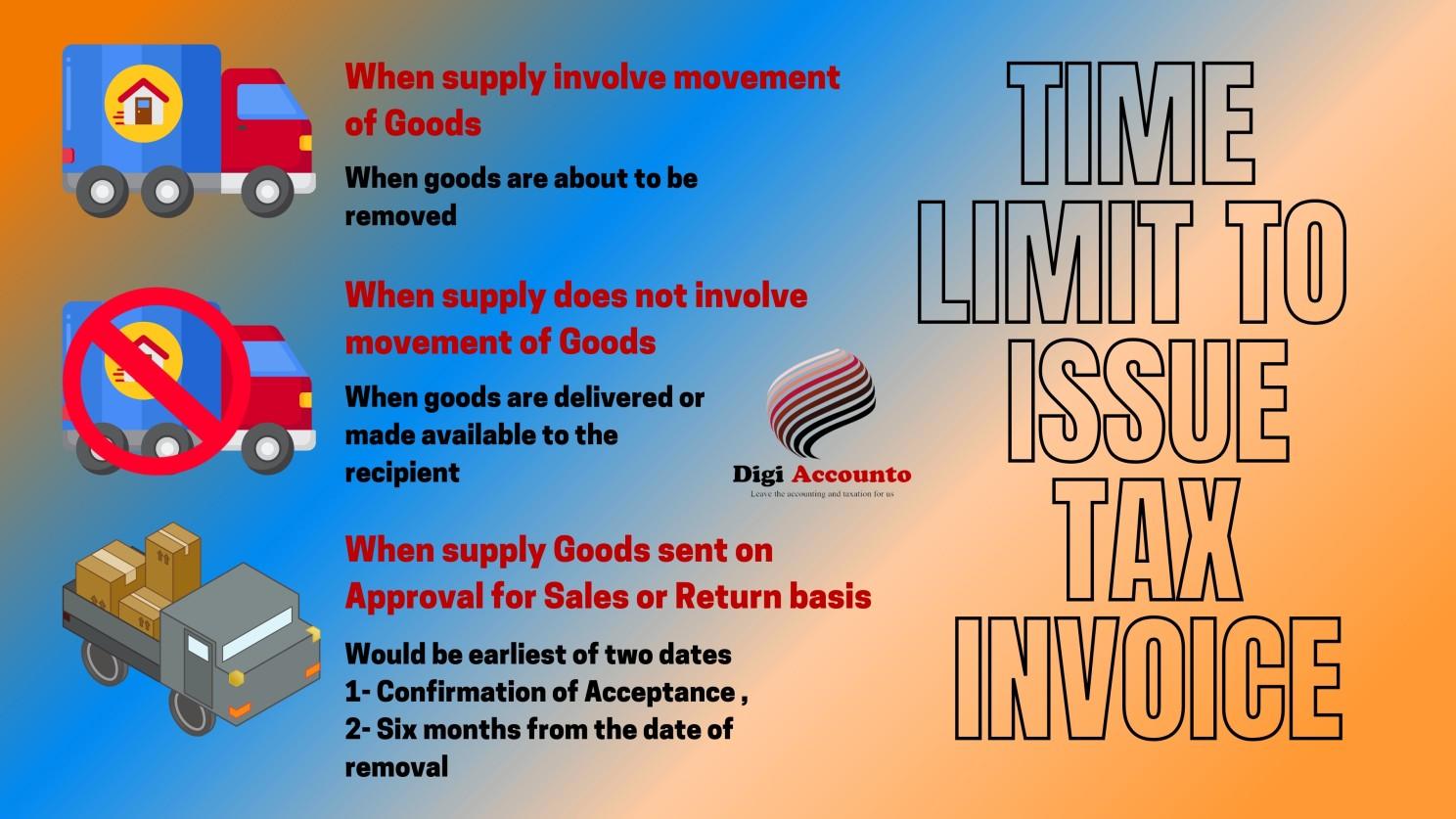

Now, it become important to know the provisions in relation to last date to issue invoice under GST law.

So friends provisions in this regards are mentioned in section 31

According to this last date is different in various scenarios

Where supply Involving Movement of Goods

In that case invoice must be issued at the time when the goods are about to be removed.

Now what if supply not Involving Movement of Goods

Where the supply not involving movement of Goods then an Invoice must be issued at that time when goods are delivered or made available to the recipient.

In case of Goods on approval or sale or return, what will be the last date for issue of invoice?

What happens sometimes, being a supplier, you send goods to customer, for selection or approval on the same, most of the time customer confirms the goods and get it purchased after making payment instantly or at later date. Now we need to know in this case, what will be the last date to issue invoice by supplier to customer.

So, friends last date would be earliest of following two dates

1. Confirmation of acceptance by customer/ recipient

2. 6 Months from the date of removal of goods from supplier

So these were the provisions for time of supply of goods under forward charge mechanism now comes to…

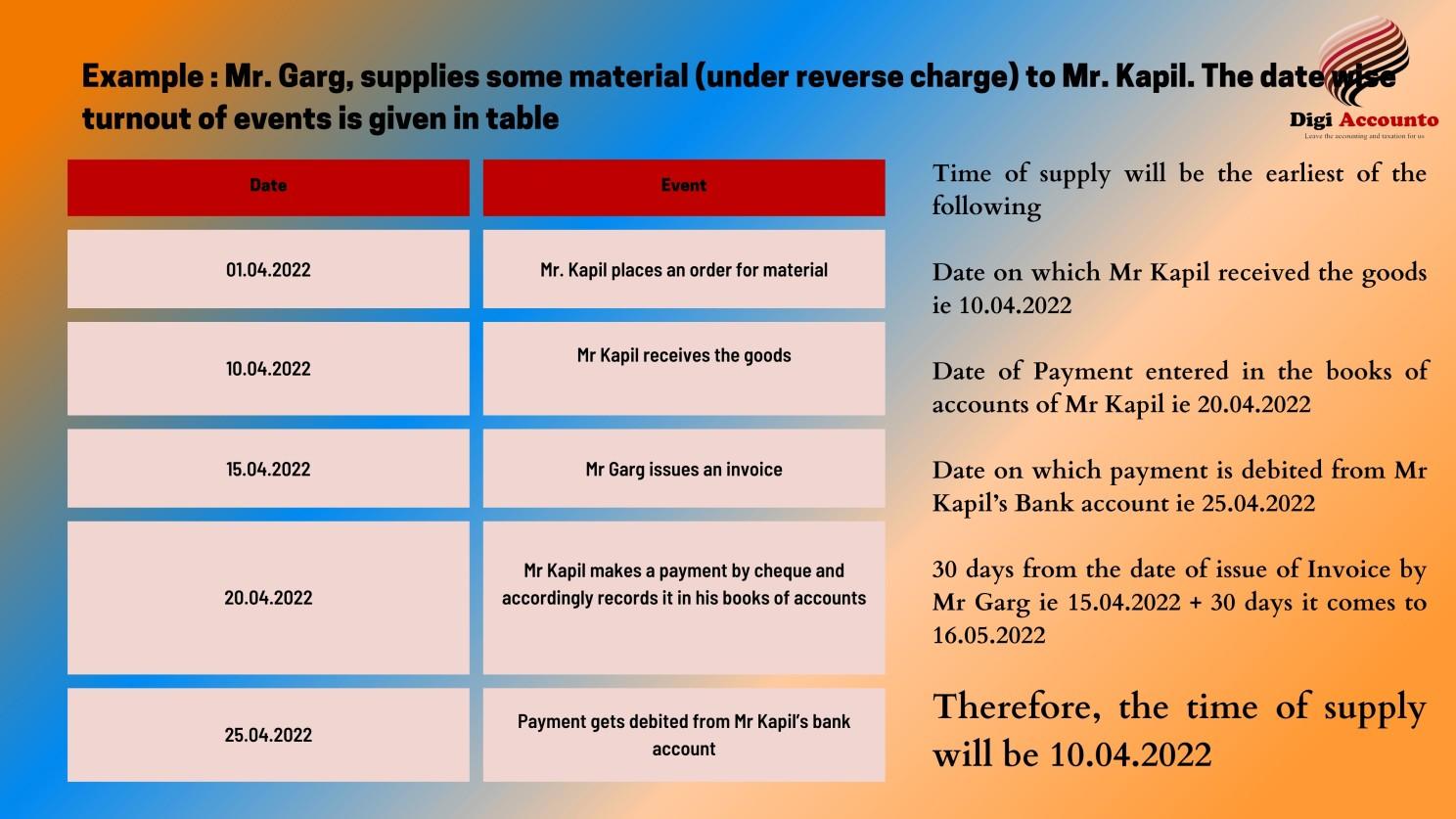

Provision for time of supply of goods under reverse charge mechanism ie when recipient is liable to pay GST

Friends, according to GST provisions, in case of supply of goods under reverse charge mechanism, the time of supply will be at the earliest of the following four dates:

1. Date on which recipient received goods

2. Date of payment as entered in the books of accounts of the recipient

3. Date on which payment is debited in the bank account of recipient

4. 30 days from the date of issue of invoice or other documents by whatever name called in lieu of supply by supplier.

Time of Supply under GST Law | How to Determine Time of Supply Under GST Act | Time of Supply of Goods | Time of Supply | Digi Accounto | Business ATM Services | Time of Supply under Reverse Charge

That’s all about Time of supply of goods, now we come to

Time of supply of services….

Provision for time of supply of services under forward charge mechanism ie when supplier is liable to pay GST

Friends, according to GST provisions, in case of supply of services under forward charge mechanism, the time of supply will be at the earliest of the following three dates:

1. Date on which supplier issues invoice

2. Last date on which invoice is required to be issued under GST law (ie 30 days from the date of completion of services by supplier)

3. Date at which supplier received the payment in respect of such supply

It is to be noted that, if invoice is not issued by supplier within prescribed time, then time of supply would be the earliest of following:

1. Date of completion of services

2. Date of receipt of payment

Time of Supply under GST Law | How to Determine Time of Supply Under GST Act | Time of Supply of Goods | Time of Supply | Digi Accounto | Business ATM Services | Time of Supply under Reverse Charge

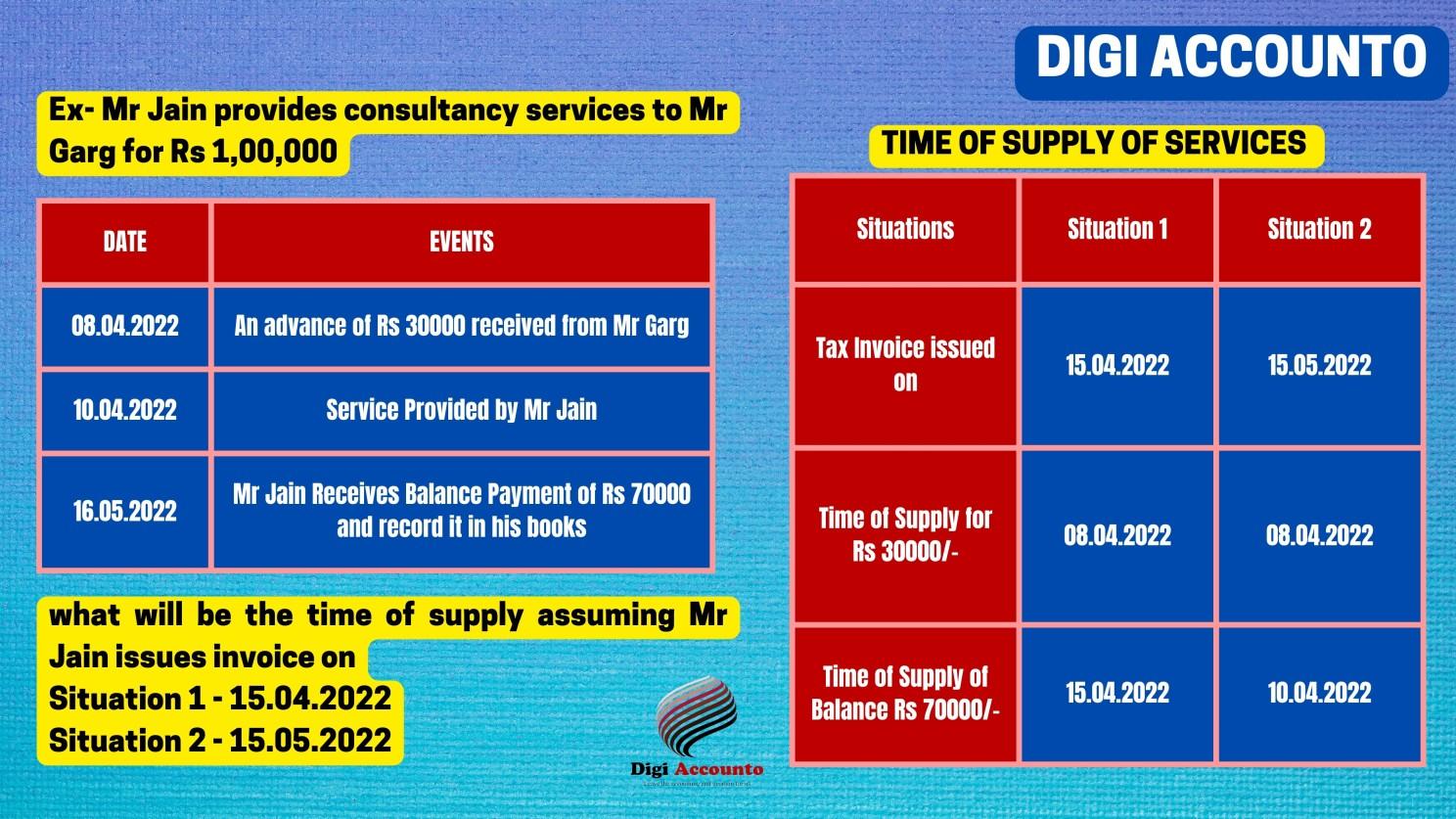

Solution

Situation 1 – for Advance payment 30000 time of supply would be earliest of following

A) 08.04.2022 – date of receipt of Advance

B) 15.04.2022 – date of issue of Invoice

It comes 08.04.2022

And for balance payment 70000 time of supply would be earliest of following

A) 15.04.2022 – date of issue of invoice

B) 10.05.2022 – 30 days from the date of provision of services (Mean last date for issue of invoice under GST law in case of supply of services)

C) 16.05.2022 – date of receipt of payment by Mr Jain

It comes 15.04.2022

So, for Advance payment of Rs 30000 time of supply would be 08.04.2022 and balance payment of Rs 70000 time of supply would be 15.04.2022

Now comes to situation 2

for Advance payment 30000 time of supply would be earliest of following

A) 08.04.2022 – date of receipt of Advance

B) 15.05.2022 – date of issue of Invoice

It comes 08.04.2022

And for balance payment 70000 time of supply would be earliest of following

A) 10.04.2022 – date of completion of services

B) 16.05.2018 – date of receipt of payment

It comes 10.04.2022

So, for Advance payment of Rs 30000 time of supply would be 08.04.2022 and balance payment of Rs 70000 time of supply would be 10.04.2022 (because invoice was not issued by supplier within prescribed time limit)

So, friends that all about Time of Supply provisions under GST Law

In case of any query or support do contact with us

Choose Digi – Karo Compliance easy

Choose Digi Accounto as your compliance partner as we are Accurate, Professional and Cost effective.

Time of Supply under GST Law | How to Determine Time of Supply Under GST Act | Time of Supply of Goods | Time of Supply | Digi Accounto | Business ATM Services | Time of Supply under Reverse Charge

To get all Business ATM ie Business Accounting and Taxation Mantra direct to you inbox please like subscribe and follow us on our social media platforms

Facebook Linkedin Instagram YouTube

Thanks friend

Accutech Digi Accounto Private Limited

Delhi | Gurgaon | Ghaziabad | Noida

+91 9953747282 | +91 8810409730